Supercuts 2010 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROVALLIANCE SAS

CONSOLIDATED FINANCIAL STATEMETS

DECEMBER 31, 2009 AND 2008

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(INFORMATION AS OF DECEMBER 31, 2009 AND FOR THE YEAR THEN ENDED NOT

COVERED BY AUDITORS' REPORT INCLUDED HEREIN)

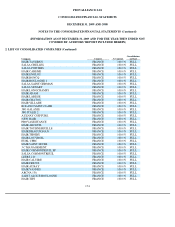

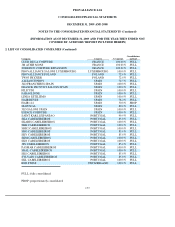

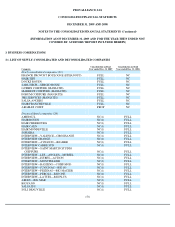

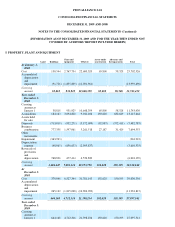

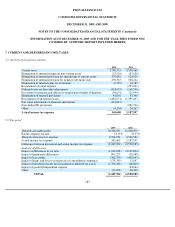

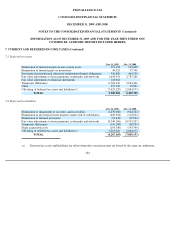

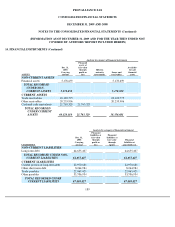

6. NON-CURRENT FINANCIAL ASSETS

182

Investments in

non-consolidated

companies

Loans and

advances to

subsidiaries and

associates

Other

investment

securities Loans

Other

non-current

financial

assets(1) Total

At January 1, 2008

Cost

158,813

1,601

3,419

2,575,551

2,739,384

Accumulated

amortization and

impairment

(28,000

)

(45,761

)

(73,761

)

Carrying amount

130,813

1,601

3,419

2,529,790

2,665,623

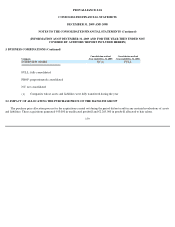

Year ended

December 31, 2008

Carrying amount at

January 1

130,813

1,601

3,419

2,529,790

2,665,623

Acquisitions

13,010

5,000

992,032

1,010,042

Assets held for sale

Disposals

(35,307

)

(250,263

)

(285,570

)

Business

combinations

1,022,331

254,951

2,281

139,571

1,372,216

2,791,350

Other movements

Impairment

(1,048,547

)

(1,048,547

)

Amortization expense

Reversals of

provisions and

amortization

45,761

45,761

Carrying amount

104,597

267,961

3,882

112,683

4,689,536

5,178,659

At December 31,

2008

Cost

1,181,144

267,961

3,882

112,683

4,689,536

6,255,206

Accumulated

amortization and

impairment

(1,076,547

)

(1,076,547

)

Carrying amount

104,597

267,961

3,882

112,683

4,689,536

5,178,659

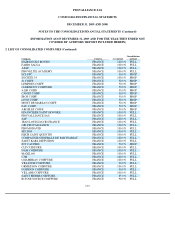

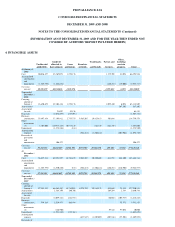

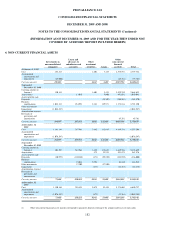

Year ended

December 31, 2009

Carrying amount at

January 1

104,597

267,961

3,882

112,683

4,689,536

5,178,659

Acquisitions

473

33,225

533,878

567,576

Assets held for sale

Disposals

(30,979

)

(120,380

)

(471

)

(55,250

)

(128,920

)

(336,000

)

Business

combinations

74,044

5,791

84,110

163,945

Other movements

37,200

(37,200

)

Impairment

(473

)

(12,365

)

(12,838

)

Amortization expense

Reversals of

provisions and

amortization

Carrying amount

73,618

258,825

9,202

53,458

5,166,239

5,561,342

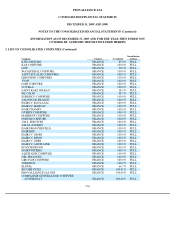

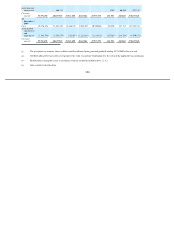

At December 31,

2009

Cost

1,150,165

258,825

9,675

53,458

5,178,604

6,650,727

Accumulated

amortization and

impairment

(1,076,547

)

(473

)

(12,365

)

(1,089,385

)

Carrying amount

73,618

258,825

9,202

53,458

5,166,239

5,561,342

(1)

Other non-current financial assets mainly correspond to guarantee deposits relating to the commercial leases of each salon.