Supercuts 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

As a result of the repayment of a portion of the senior term notes during the twelve months ended June 30, 2010, the Company incurred

$12.8 million in make-whole payments and other fees along with $5.2 million in interest rate swap settlements, as discussed in Note 9 to the

Consolidated Financial Statements, totaling $18.0 million that was recorded as interest expense within the Consolidated Statement of

Operations.

Acquisitions

Acquisitions are discussed throughout Management's Discussion and Analysis in this Item 7, as well as in Note 4 to the Consolidated

Financial Statements in Part II, Item 8 of this Form 10-K. The acquisitions were funded primarily from operating cash flow, debt and the

issuance of common stock.

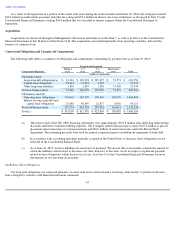

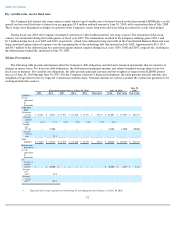

Contractual Obligations and Commercial Commitments

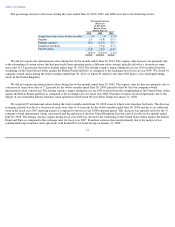

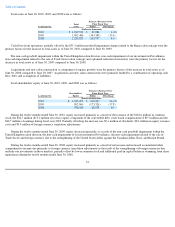

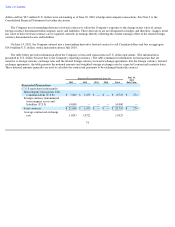

The following table reflects a summary of obligations and commitments outstanding by payment date as of June 30, 2010:

On-Balance Sheet Obligations

Our long-term obligations are composed primarily of senior term notes, term loan and a revolving credit facility. A portion of the term

loan is hedged by contracts with financial institutions commonly

67

Payments due by period

Contractual Obligations Within 1

years 1 - 3

years 3 - 5

years More than 5

years Total

(Dollars in thousands)

On

-

balance sheet:

Long

-

term debt obligations(a)

$

41,216

$

130,294

$

187,475

$

53,571

$

412,556

Capital lease obligations

10,413

13,518

3,542

—

27,473

Other long

-

term liabilities

1,856

2,867

1,906

19,306

25,935

Total on

-

balance sheet

53,485

146,679

192,923

72,877

465,964

Off

-

balance sheet(b):

Operating lease obligations

301,865

425,379

209,865

107,976

1,045,085

Interest on long-

term debt and

capital lease obligations

25,689

40,349

21,077

8,036

95,151

Total off

-

balance sheet

327,554

465,728

230,942

116,012

1,140,236

Total(c)

$

381,039

$

612,407

$

423,865

$

188,889

$

1,606,200

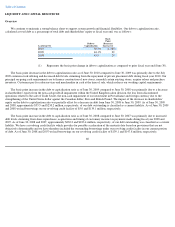

(a) The net proceeds of the July 2009 financing agreements were approximately $323.8 million after deducting underwriting

discounts and before estimated offering expenses. The Company utilized the proceeds to repay $267.0 million of private

placement senior term notes of varying maturities and $30.0 million of senior term notes under the Private Shelf

Agreement. The remaining proceeds were used for general corporate purposes including the repayment of bank debt.

(b) In accordance with accounting principles generally accepted in the United States of America, these obligations are not

reflected in the Consolidated Balance Sheet.

(c) As of June 30, 2010, we have liabilities for uncertain tax positions. We are not able to reasonably estimate the amount by

which the liabilities will increase or decrease over time; however, at this time, we do not expect a significant payment

related to these obligations within the next fiscal year. See Note 13 to the Consolidated Financial Statements for more

information on our uncertain tax positions.