Supercuts 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

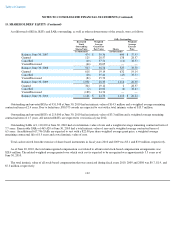

13. INCOME TAXES (Continued)

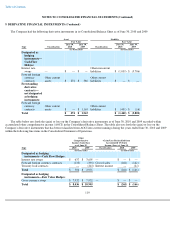

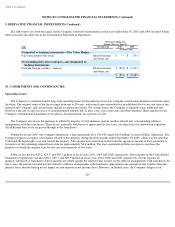

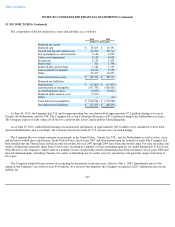

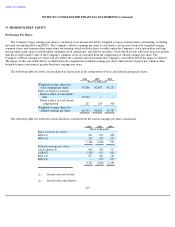

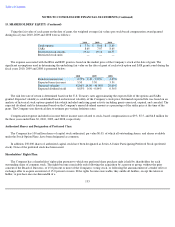

unrecognized income tax benefits, including interest and penalties, which was accounted for through the following accounts:

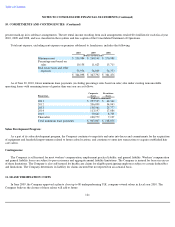

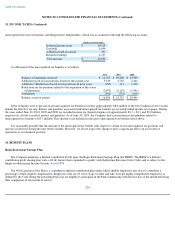

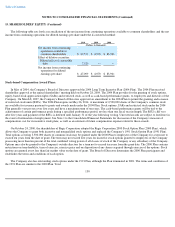

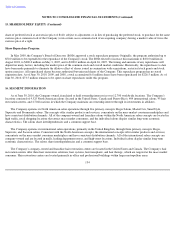

A rollforward of the unrecognized tax benefits is as follows:

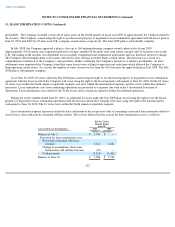

If the Company were to prevail on all unrecognized tax benefits recorded, approximately $8.2 million of the $16.9 million reserve would

benefit the effective tax rate. Interest and penalties associated with unrecognized tax benefits are recorded within income tax expense. During

the years ended June 30, 2010, 2009 and 2008 we recorded income tax (benefit)/expense of approximately $(1.1), $2.1 and $3.0 million,

respectively, for the accrual of interest and penalties. As of June 30, 2010, the Company had accrued interest and penalties related to

unrecognized tax benefits of $3.5 million. This amount is not included in the gross unrecognized tax benefits noted above.

It is reasonably possible that the amount of the unrecognized tax benefit with respect to certain of our unrecognized tax positions will

increase or decrease during the next twelve months. However, we do not expect the change to have a significant effect on our results of

operations or our financial position.

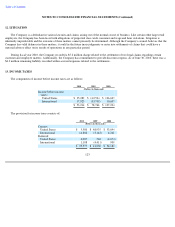

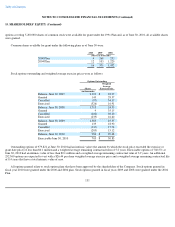

14. BENEFIT PLANS

Regis Retirement Savings Plan

The Company maintains a defined contributed 401(k) plan, the Regis Retirement Savings Plan (the RRSP). The RRSP is a defined

contribution profit sharing plan with a 401(k) feature that is intended to qualify with the Internal Revenue Code (Code) and is subject to the

Employee Retirement Income Security Act of 1974.

The 401(k) portion of the Plan is a contributory defined contribution plan under which eligible employees may elect to contribute a

percentage of their eligible compensation. Employees who are 18 years of age or older and who were not highly compensated employees as

defined by the Code during the preceding Plan year are eligible to participate in the Plan commencing with the first day of the month following

their completion of one month of service.

126

(Dollars in thousands)

Deferred income taxes

$

10,128

Goodwill

6,094

Additional paid

-

in capital

237

Retained earnings

4,237

Total increase

$

20,696

2010 2009 2008

Balance at beginning of period

$

14,787

$

20,400

$

22,500

Additions based on tax positions related to the current year

5,549

2,765

2,466

Additions / (Reductions) based on tax positions of prior years

(185

)

121

1,498

Reductions on tax positions related to the expiration of the statue

of limitations

(2,993

)

(8,167

)

(5,446

)

Settlements

(302

)

(332

)

(618

)

Balance at end of period

$

16,856

$

14,787

$

20,400