Supercuts 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

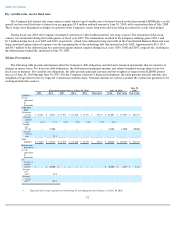

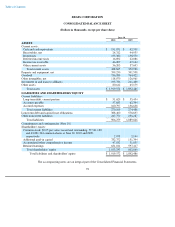

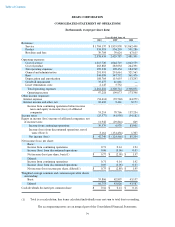

REGIS CORPORATION

CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share data)

The accompanying notes are an integral part of the Consolidated Financial Statements.

79

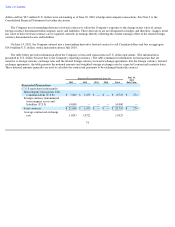

Years Ended June 30,

2010 2009 2008

Revenues:

Service

$

1,784,137

$

1,833,958

$

1,862,490

Product

534,593

556,205

551,286

Royalties and fees

39,704

39,624

67,615

2,358,434

2,429,787

2,481,391

Operating expenses:

Cost of service

1,015,720

1,044,719

1,062,559

Cost of product

263,883

283,038

264,391

Site operating expenses

199,338

190,456

184,769

General and administrative

291,991

291,661

321,563

Rent

344,098

347,792

361,476

Depreciation and amortization

108,764

115,655

113,293

Goodwill impairment

35,277

41,661

—

Lease termination costs

2,145

5,732

—

Total operating expenses

2,261,216

2,320,714

2,308,051

Operating income

97,218

109,073

173,340

Other income (expense):

Interest expense

(54,414

)

(39,768

)

(44,279

)

Interest income and other, net

10,410

9,461

8,173

Income from continuing operations before income

taxes and equity in income (loss) of affiliated

companies

53,214

78,766

137,234

Income taxes

(25,577

)

(41,950

)

(54,182

)

Equity in income (loss) income of affiliated companies, net

of income taxes

11,942

(29,846

)

849

Income from continuing operations

39,579

6,970

83,901

Income (loss) from discontinued operations, net of

taxes (Note 2)

3,161

(131,436

)

1,303

Net income (loss)

$

42,740

$

(124,466

)

$

85,204

Net income (loss) per share:

Basic:

Income from continuing operations

0.71

0.16

1.94

Income (loss) from discontinued operations

0.06

(3.06

)

0.03

Net income (loss) per share, basic(1)

$

0.77

$

(2.90

)

$

1.97

Diluted:

Income from continuing operations

0.71

0.16

1.92

Income (loss) from discontinued operations

0.05

(3.05

)

0.03

Net income (loss) income per share, diluted(1)

$

0.75

$

(2.89

)

$

1.95

Weighted average common and common equivalent shares

outstanding:

Basic

55,806

42,897

43,157

Diluted

66,753

43,026

43,587

Cash dividends declared per common share

$

0.16

$

0.16

$

0.16

(1)

Total is a recalculation; line items calculated individually may not sum to total due to rounding.