Supercuts 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

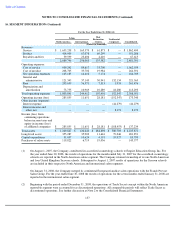

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. BENEFIT PLANS (Continued)

The discretionary employer contribution profit sharing portion of the Plan is a noncontributory defined contribution component covering

full-time and part-time employees of the Company who have at least one year of eligible service, 1,000 hours of service during the Plan year,

are employed by the Employer on the last day of the Plan year and are employed at the home office or distribution centers, or as area or

regional supervisors, artistic directors or educators, and that are not highly compensated employees as defined by the Code. Participants'

interest in the noncontributory defined contribution component become 20.0 percent vested after completing two years of service with vesting

increasing 20.0 percent for each additional year of service, and with participants becoming fully vested after six full years of service.

Nonqualified Deferred Salary Plan:

The Company maintains a Nonqualified Deferred Salary Plan (Executive Plan) with covers Company officers, field supervisors,

warehouse and corporate office employees who are highly compensated. The discretionary employer contribution profit sharing portion of the

Executive Plan is a noncontributory defined contribution component in which participants interest become 20.0 percent vested after completing

two years of service with vesting increasing 20.0 percent for each additional year of service, and with participants becoming fully vested after

six full years of service.

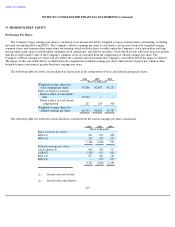

Stock Purchase Plan:

The Company has an employee stock purchase plan (ESPP) available to substantially all employees. Under the terms of the ESPP, eligible

employees may purchase the Company's common stock through payroll deductions. The Company contributes an amount equal to 15.0 percent

of the purchase price of the stock to be purchased on the open market and pays all expenses of the ESPP and its administration, not to exceed

an aggregate contribution of $10.0 million. As of June 30, 2010, the Company's cumulative contributions to the ESPP totaled $8.0 million.

Franchise Stock Purchase Plan:

The Company has a franchise stock purchase plan (FSPP) available to substantially all franchisee employees. Under the terms of the plan,

eligible franchisees and their employees may purchase the Company's common stock. The Company contributes an amount equal to five

percent of the purchase price of the stock to be purchased on the open market and pays all expenses of the plan and its administration, not to

exceed an aggregate contribution of $0.7 million. As of June 30, 2010, the Company's cumulative contributions to the FSPP totaled

$0.2 million.

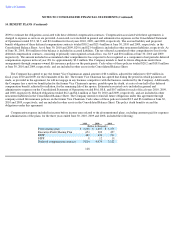

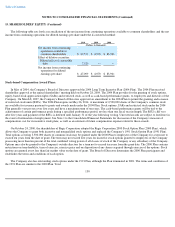

Deferred Compensation Contracts:

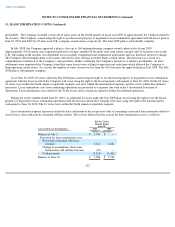

The Company has agreed to pay the Chief Executive Officer, commencing upon his retirement, an amount equal to 60.0 percent of his

salary, adjusted for inflation, for the remainder of his life. Additionally, the Company has a survivor benefit plan payable upon his death at a

rate of one half of his deferred compensation benefit, adjusted for inflation, for the remaining life of his spouse. In addition, the Company has

other unfunded deferred compensation contracts covering key executives within the Company. The key executives' benefits are based on years

of service and the employee's compensation prior to departure. The Company utilizes a June 30 measurement date for these deferred

compensation contracts, a discount rate based on the Aa Bond index rate (5.4 and 6.20 percent at June 30, 2010 and 2009, respectively) and

projected salary increases of 4.0 percent at June 30, 2010 and

127