Supercuts 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

infrastructure, recruitment of experienced hair care management and adequate store staff, and leasing of quality sites. The principal factors of

competition in the affordable hair care category are quality, consistency and convenience. The Company continually strives to improve its

performance in each of these areas and to create additional points of differentiation versus the competition. In order to obtain locations in

shopping malls, the Company must be competitive as to rentals and other customary tenant obligations.

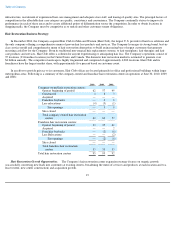

Hair Restoration Business Strategy:

In December 2004, the Company acquired Hair Club for Men and Women (Hair Club), the largest U.S. provider of hair loss solutions and

the only company offering a comprehensive menu of proven hair loss products and services. The Company leverages its strong brand, best-in-

class service model and comprehensive menu of hair restoration alternatives to build an increasing base of repeat customers that generate

recurring cash flow for the Company. From its traditional non-surgical hair replacement systems, to hair transplants, hair therapies and hair

care products and services, Hair Club offers a solution for anyone experiencing or anticipating hair loss. The Company's operations consist of

95 locations (33 franchise locations) in the United States and Canada. The domestic hair restoration market is estimated to generate over

$4 billion annually. The competitive landscape is highly fragmented and comprised of approximately 4,000 locations. Hair Club and its

franchisees have the largest market share, with approximately five percent based on customer count.

In an effort to provide privacy to its customers, Hair Club offices are located primarily in office and professional buildings within larger

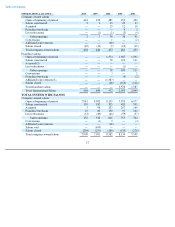

metropolitan areas. Following is a summary of the company-owned and franchise hair restoration centers in operation at June 30, 2010, 2009,

and 2008:

Hair Restoration Growth Opportunities. The Company's hair restoration center expansion strategy focuses on organic growth

(successfully converting new leads into customers at existing centers, broadening the menu of services and products at each location and to a

lesser extent, new center construction) and acquisition growth.

19

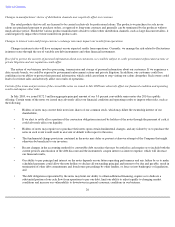

2010 2009 2008

Company

-

owned hair restoration centers:

Open at beginning of period

62

57

49

Constructed

4

8

3

Acquired

—

—

—

Franchise buybacks

—

2

6

Less relocations

(4

)

(5

)

(1

)

Site openings

—

5

8

Sites closed

—

—

—

Total company-

owned hair restoration

centers

62

62

57

Franchise hair restoration centers:

Open at beginning of period

33

35

41

Acquired

—

—

2

Franchise buybacks

—

(

2

)

(6

)

Less Relocations

—

—

(

2

)

Site openings

—

(

2

)

(6

)

Sites closed

—

—

—

Total franchise hair restoration

centers

33

33

35

Total hair restoration centers

95

95

92