Starwood 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

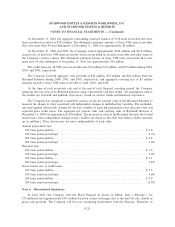

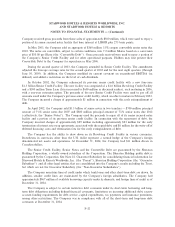

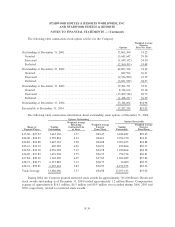

The weighted average interest rate for short-term borrowings was 5.44% and 5.15% at December 31, 2004

and 2003, respectively, and their fair values approximated carrying value given their short-term nature. These

average interest rates are composed of interest rates on both U.S. dollar and non-U.S. dollar denominated

indebtedness.

For adjustable rate debt, fair value approximates carrying value due to the variable nature of the interest

rates. For non-public Ñxed rate debt, fair value is determined based upon discounted cash Öows for the debt at

rates deemed reasonable for the type of debt and prevailing market conditions and the length to maturity for

the debt. The estimated fair value of debt at December 31, 2004 and 2003 was $4.8 billion and $4.7 billion,

respectively, and was determined based on quoted market prices and/or discounted cash Öows. See Note 18.

Derivative Financial Instruments for additional discussion regarding the Company's interest rate swap

agreements.

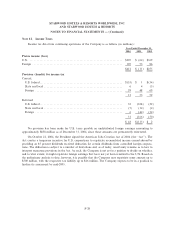

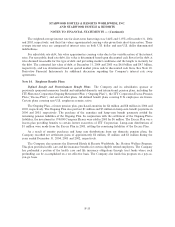

Note 14. Employee BeneÑt Plans

DeÑned BeneÑt and Postretirement BeneÑt Plans. The Company and its subsidiaries sponsor or

previously sponsored numerous funded and unfunded domestic and international pension plans, including the

ITT Sheraton Corporation Ongoing Retirement Plan (""Ongoing Plan''), the ITT Corporation Excess Pension

Plan (""Excess Plan'') and several other plans. All deÑned beneÑt plans covering U.S. employees are frozen.

Certain plans covering non-U.S. employees remain active.

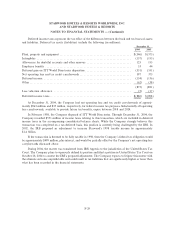

The Ongoing Plan, a frozen pension plan, purchased annuities for $4 million and $8 million in 2004 and

2003, respectively. The Ongoing Plan also paid out $1 million and $3 million in lump-sum beneÑt payments in

2004 and 2003, respectively. The purchase of the annuities and lump-sum beneÑt payments settled the

remaining pension liabilities of the Ongoing Plan. In conjunction with the settlement of the Ongoing Plan's

liabilities, the investment in 174,000 Company Shares were sold in 2003 for $6 million. The Excess Plan was a

frozen plan providing beneÑts to certain former executives of ITT Corporation. Lump-sum distributions of

$1 million were made from the Excess Plan in 2003, settling the remaining liabilities of the Excess Plan.

As a result of annuity purchases and lump sum distributions from our domestic pension plans, the

Company recorded net settlement gains of approximately $2 million, $5 million and $3 million during the

years ended December 31, 2004, 2003 and 2002, respectively.

The Company also sponsors the Starwood Hotels & Resorts Worldwide, Inc. Retiree Welfare Program.

This plan provides health care and life insurance beneÑts for certain eligible retired employees. The Company

has prefunded a portion of the health care and life insurance obligations through trust funds where such

prefunding can be accomplished on a tax eÅective basis. The Company also funds this program on a pay-as-

you-go basis.

F-33