Starwood 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

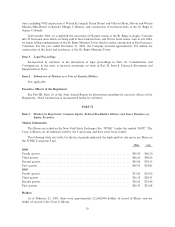

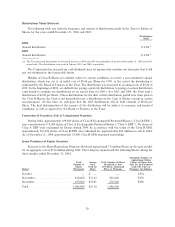

Item 6. Selected Financial Data.

The following Ñnancial and operating data should be read in conjunction with the information set forth

under ""Management's Discussion and Analysis of Financial Condition and Results of Operations'' and our

consolidated Ñnancial statements and related notes thereto appearing elsewhere in this Joint Annual Report

and incorporated herein by reference.

Year Ended December 31,

2004 2003 2002 2001 2000

(In millions, except per Share data)

Income Statement Data

Revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $5,368 $4,630 $4,588 $4,633 $4,945

Operating income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 653 $ 427 $ 551 $ 576 $ 968

Income from continuing operationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 369 $ 105 $ 251 $ 147 $ 397

Diluted earnings per Share from continuing operations ÏÏÏ $ 1.72 $ 0.51 $ 1.22 $ 0.71 $ 1.94

Operating Data

Cash from continuing operationsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 577 $ 755 $ 744 $ 736 $ 796

Cash from (used for) investing activitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (415) $ 515 $ (282) $ (617) $ (660)

Cash used for Ñnancing activities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (273) $ (979) $ (487) $ (162) $ (417)

Aggregate cash distributions paid ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 172 $ 170 $ 40(a) $ 156 $ 134

Cash distributions declared per Share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.84 $ 0.84 $ 0.84 $ 0.80 $ 0.69

(a) This balance reÖects the payment made in January 2002 for the dividends declared for the fourth quarter of 2001. As the Trust now

declares dividends annually, the 2002 annual dividend payment, which was made in January 2003, is reÖected in the 2003 column.

At December 31,

2004 2003 2002 2001 2000

(In millions)

Balance Sheet Data

Total assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $12,298 $11,857 $12,190 $12,416 $12,627

Long-term debt, net of current maturities and

including exchangeable units and Class B

preferred shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 3,823 $ 4,424 $ 4,500 $ 5,301 $ 5,090

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Management's Discussion and Analysis of Financial Condition and Results of Operations (""MD&A'')

discusses our consolidated Ñnancial statements, which have been prepared in accordance with accounting

principles generally accepted in the United States. The preparation of these consolidated Ñnancial statements

requires management to make estimates and assumptions that aÅect the reported amounts of assets and

liabilities, the disclosure of contingent assets and liabilities at the date of the consolidated Ñnancial statements

and the reported amounts of revenues and costs and expenses during the reporting periods. On an ongoing

basis, management evaluates its estimates and judgments, including those relating to revenue recognition, bad

debts, inventories, investments, plant, property and equipment, goodwill and intangible assets, income taxes,

Ñnancing operations, frequent guest program liability, self-insurance claims payable, restructuring costs,

retirement beneÑts and contingencies and litigation.

Management bases its estimates and judgments on historical experience and on various other factors that

are believed to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying value of assets and liabilities that are not readily available from other sources.

Actual results may diÅer from these estimates under diÅerent assumptions and conditions.

21