Starwood 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

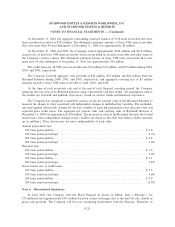

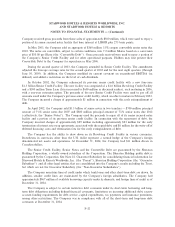

accordance with SFAS No. 144, the accompanying consolidated Ñnancial statements reÖect the results of

operations of the Principe as a discontinued operation. Interest expense of $7 million and $15 million,

respectively, for the years ended December 31, 2003 and 2002 was allocated to discontinued operations based

upon the amount of Euro denominated debt that was required to be repaid upon the consummation of the sale.

The amount of Euro denominated debt allocated to discontinued operations was approximately $284 million at

December 31, 2002. Summary Ñnancial information for discontinued operations is as follows (in millions):

Year Ended

December 31,

2004 2003 2002

Income Statement Data

Revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $ 22 $ 42

Operating income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $ 5 $ 12

Interest expense on debt repaid with sales proceeds ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $ 7 $ 15

Income tax expenseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $ Ì $ 2

Loss from operations, net of tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $ (2) $ (5)

Gain on disposition, net of tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $26 $206 $109

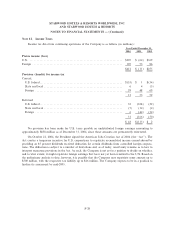

For the year ended December 31, 2004, the net gain on disposition primarily consists of the reversal of

$10 million of reserves set up in conjunction with the sale of the Company's former gaming business in 1999.

The related contingencies were resolved in January 2005 and, therefore, the reserves are no longer required.

The gain on disposition also includes a tax beneÑt of $16 million associated with the disposition of the

Company's former gaming business as a result of the favorable resolution of certain tax matters.

For the year ended December 31, 2003, the net gain on disposition consists of $174 million of gains

recorded in connection with the sale of the Principe on June 30, 2003 and the reversal of $32 million of

reserves relating to the Company's former gaming business disposed of in 1999 that are no longer required as

the related contingencies have been resolved.

During 2002, the Company recorded an after tax gain of $109 million from discontinued operations

primarily related to the issuance of new Internal Revenue Service (""IRS'') regulations in early 2002, which

allowed the Company to recognize a $79 million tax beneÑt from a tax loss on the 1999 sale of its former

gaming business. The tax loss was previously disallowed under the old regulations. In addition, the Company

recorded a $25 million gain resulting from an adjustment to the Company's tax basis in ITT World

Directories, a subsidiary which was disposed of in early 1998 through a tax deferred reorganization. The

increase in the tax basis has the eÅect of reducing the deferred tax charge recorded on the disposition in 1998.

This gain also included the reversal of $5 million of liabilities set up in conjunction with the sale of the former

gaming business that are no longer required as the related contingencies have been resolved.

F-24