Starwood 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

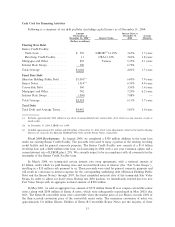

Cash Used for Financing Activities

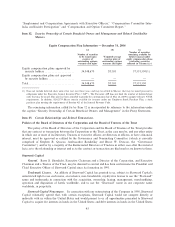

Following is a summary of our debt portfolio (including capital leases) as of December 31, 2004:

Amount Interest Rate at

Outstanding at December 31, Average

December 31, 2004(a) Interest Terms 2004 Maturity

(Dollars in millions)

Floating Rate Debt

Senior Credit Facility:

Term Loan ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 550 LIBOR(b)°1.25% 3.65% 1.5 years

Revolving Credit Facility ÏÏÏÏÏÏÏ 11 CBA°1.25% 3.81% 1.8 years

Mortgages and OtherÏÏÏÏÏÏÏÏÏÏÏÏÏ 207 Various 5.37% 2.1 years

Interest Rate SwapsÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 300 6.72% Ì

Total/Average ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,068 4.85% 1.7 years

Fixed Rate Debt

Sheraton Holding Public Debt ÏÏÏÏÏ $1,058(c) 6.00% 7.9 years

Senior NotesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,514(c) 6.70% 4.9 years

Convertible Debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 360 3.50% 1.4 years

Mortgages and OtherÏÏÏÏÏÏÏÏÏÏÏÏÏ 742 7.25% 6.2 years

Interest Rate SwapsÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (300) 7.88% Ì

Total/Average ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $3,374 6.11% 5.7 years

Total Debt

Total Debt and Average Terms ÏÏÏÏ $4,442 5.81% 5.0 years

(a) Excludes approximately $438 million of our share of unconsolidated joint venture debt, all of which was non-recourse, except as

noted earlier.

(b) At December 31, 2004, LIBOR was 2.40%

(c) Included approximately $11 million and $18 million at December 31, 2004 of fair value adjustments related to the Ñxed-to-Öoating

interest rate swaps for the Sheraton Holding Public Debt and the Senior Notes, respectively.

Fiscal 2004 Developments. In August 2004, we completed a $300 million addition to the term loan

under our existing Senior Credit Facility. The proceeds were used to repay a portion of the existing revolving

credit facility and for general corporate purposes. The Senior Credit Facility now consists of a $1.0 billion

revolving loan and a $600 million term loan, each maturing in 2006 with a one year extension option and a

current interest rate of LIBOR plus 1.25%. We currently expect to be in compliance with all covenants for the

remainder of the Senior Credit Facility term.

In March 2004, we terminated certain interest rate swap agreements, with a notional amount of

$1 billion, under which we paid Öoating rates and received Ñxed rates of interest (the ""Fair Value Swaps''),

resulting in a $33 million cash payment to us. These proceeds were used for general corporate purposes and

will result in a decrease to interest expense for the corresponding underlying debt (Sheraton Holding Public

Debt and the Senior Notes) through 2007, the Ñnal scheduled maturity date of the terminated Fair Value

Swaps. In order to adjust our Ñxed versus Öoating rate debt position, we immediately entered into two new

Fair Value Swaps with an aggregate notional amount of $300 million.

In May 2001, we sold an aggregate face amount of $572 million Series B zero coupon convertible senior

notes (along with $244 million of Series A notes, which were subsequently repurchased in May 2002) due

2021. The Series B convertible notes were convertible when the market price of our Shares exceeds 120% of

the then-accreted conversion price of the convertible senior notes. The maximum conversion of notes was

approximately 5.8 million Shares. Holders of Series B Convertible Senior Notes put the majority of these

33