Starwood 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CRITICAL ACCOUNTING POLICIES

We believe the following to be our critical accounting policies:

Revenue Recognition. Our revenues are primarily derived from the following sources: (1) hotel and

resort revenues at our owned, leased and consolidated joint venture properties; (2) management and franchise

fees; (3) vacation ownership revenues; and (4) other revenues which are ancillary to our operations.

Generally, revenues are recognized when the services have been rendered. The following is a description of the

composition of our revenues:

‚ Owned, Leased and Consolidated Joint Ventures Ì Represents revenue primarily derived from hotel

operations, including the rental of rooms and food and beverage sales from owned leased or

consolidated joint venture hotels and resorts. Revenue is recognized when rooms are occupied and

services have been rendered. These revenues are impacted by global economic conditions aÅecting the

travel and hospitality industry as well as relative market share of the local competitive set of hotels.

REVPAR is a leading indicator of revenue trends at owned, leased and consolidated joint venture

hotels.

‚ Management and Franchise Fees Ì Represents fees earned on hotels managed worldwide, usually

under long-term contracts, and franchise fees received in connection with the franchise of the our

Sheraton, Westin, Four Points by Sheraton and Luxury Collection brand names. Management fees are

comprised of a base fee, which is generally based on a percentage of gross revenues, and an incentive

fee, which is generally based on the property's proÑtability. For any time during the year, incentive fees

are recognized for the fees due and earned as if the contract was terminated at that date, exclusive of

any termination fees due or payable. Therefore, during periods prior to year-end, the incentive fees

recorded may not be indicative of the eventual incentive fees that will be recognized at year-end as

conditions and incentive hurdle calculations may not be Ñnal. Franchise fees are generally based on a

percentage of hotel room revenues. As with hotel revenues discussed above, these revenue sources are

aÅected by conditions impacting the travel and hospitality industry as well as competition from other

hotel management and franchise companies.

‚ Vacation Ownership and Residential Ì We recognize revenue from VOI sales and Ñnancings and the

sales of residential units which are typically a component of mixed use projects that include a hotel.

Such revenues are impacted by the state of the global economies and, in particular, the U.S. economy,

as well as interest rate and other economic conditions aÅecting the lending market. We determine the

portion of revenues to recognize for sales accounted for under the percentage of completion method

based on judgments and estimates including total project costs to complete. Additionally, we record

reserves against these revenues based on expected default levels. Changes in costs could lead to

adjustments to the percentage of completion status of a project, which may result in diÅerences in the

timing and amount of revenues recognized from the projects. We anticipate developing future high end

VOI projects adjacent to or as part of our luxury resorts, resulting in cross-selling opportunities and an

audience of higher-end purchasers, yielding both higher revenues and reduced risks associated with

Ñnancing these VOI sales.

Frequent Guest Program. SPG is our frequent guest incentive marketing program. SPG members earn

points based on spending at our properties, as incentives to Ñrst time buyers of VOIs and, to a lesser degree,

through participation in aÇliated partners' programs. Points can be redeemed at most of our owned, leased,

managed and franchised properties. The cost of operating the program, including the estimated cost of award

redemption, is charged to properties based on members' qualifying expenditures. Revenue is recognized by

participating hotels and resorts when points are redeemed for hotel stays.

We, through the services of third-party actuarial analysts, determine the fair value of the future

redemption obligation based on statistical formulas which project the timing of future point redemption based

on historical experience, including an estimate of the ""breakage'' for points that will never be redeemed, and

an estimate of the points that will eventually be redeemed. Actual expenditures for SPG may diÅer from the

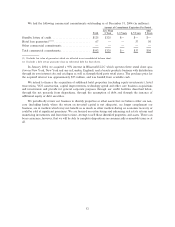

actuarially determined liability. The total actuarially determined liability as of December 31, 2004 and 2003 is

22