Starwood 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approximately $29 million related to the unamortized premium on terminated Fair Value Swaps and the fair

market value of current Fair Value Swap assets. At December 31, 2003 our debt included an increase of

approximately $57 million related to fair value swap liabilities.

If we are unable to generate suÇcient cash Öow from operations in the future to service our debt, we may

be required to sell additional assets, reduce capital expenditures, reÑnance all or a portion of our existing debt

or obtain additional Ñnancing. Our ability to make scheduled principal payments, to pay interest on or to

reÑnance our indebtedness depends on our future performance and Ñnancial results, which, to a certain extent,

are subject to general conditions in or aÅecting the hotel and vacation ownership industries and to general

economic, political, Ñnancial, competitive, legislative and regulatory factors beyond our control.

On May 6, 2003, Standard & Poor's announced its decision to downgrade our Credit Rating to BB°

(non-investment grade with a stable outlook) from BBB¿ (investment grade rating on Credit Watch with

negative implications). On January 7, 2004, Moody's Investor Services and Standard & Poor's placed our Ba1

(non-investment grade) and BB° corporate credit ratings on review/watch for a possible downgrade. The

review/watch was prompted by our announcement that we had invested $200 million in Le Meridien's senior

debt and would be in discussions to negotiate the potential recapitalization of Le Meridien. On January 27,

2005, Standard & Poor's removed our review/watch and aÇrmed our BB° rating with a stable outlook. Any

downgrading of our credit rating may result in higher borrowing costs on future Ñnancings.

In 2002, we shifted from a quarterly distribution to an annual distribution. A distribution of $0.84 per

Share, was paid in January 2005 and January 2004 to shareholders of record as of December 31, 2004 and

2003, respectively.

On October 22, 2004, the President signed the American Jobs Creation Act of 2004 (the ""Act''). The

Act creates a temporary incentive for U.S. corporations to repatriate accumulated income earned abroad by

providing an 85 percent dividends received deduction for certain dividends from controlled foreign corpora-

tions. The deduction is subject to a number of limitations and, as of today, uncertainty remains as to how to

interpret numerous provisions in the Act. As such, we are not yet in a position to decide on whether, and to

what extent, we might repatriate foreign earnings that have not yet been remitted to the U.S. Based on our

preliminary analysis to date, however, it is possible that we may repatriate some amount up to $500 million,

with the respective tax liability of up to $26 million. We expect to be in a position to Ñnalize our assessment by

mid-2005.

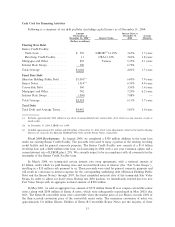

Stock Sales and Repurchases

At December 31, 2004, we had outstanding approximately 209 million Shares, 1.2 million partnership

units and 651,000 million Class A EPS and Class B EPS. Through December 31, 2004, in accordance with

the terms of the Class B EPS, approximately 567,000 shares of Class B EPS and Exchangeable Units were

redeemed for approximately $22 million. During 2004, no shares of Class A EPS were exchanged for Shares.

In 1998, the Corporation's Board of Directors approved the repurchase of up to $1 billion of Shares under

a Share repurchase program (the ""Share Repurchase Program''). On April 2, 2001, the Corporation's Board

of Directors authorized the repurchase of up to an additional $500 million of Shares under the Share

Repurchase Program. Pursuant to the Share Repurchase Program, Starwood repurchased 7.0 million Shares

in the open market for an aggregate cost of $310 million during 2004.

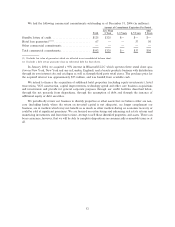

OÅ-Balance Sheet Arrangements

Our oÅ-balance sheet arrangements include beneÑcial interest in securitizations of $58 million, third-

party loan guarantees of $67 million, letters of credit of $125 million, unconditional purchase obligations of

$161 million and surety bonds of $38 million. These items are more fully discussed earlier in this section and

in the Notes to Consolidated Financial Statements, Item 8 of Part II of this report.

35