Starwood 2004 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

Dina Diagonale held various positions with the Company from January 2001 through June 2004. In 2004,

Ms. Diagonale earned a total of $241,409, which includes (i) approximately $77,500 upon the exercise of

in-the-money options and restricted stock that vested or became exercisable in the ordinary course,

(ii) Ms. Diagonale's 2003 bonus which was paid in March 2004, and (iii) base compensation and severance.

In addition, Ms. Diagonale was awarded 2,500 options to purchase Company shares in 2004, which terminated

prior to vesting upon her ceasing to be employed by the Company. Subsequent to her departure from the

Company, Ms. Diagonale married Kenneth S. Siegel, Executive Vice President and General Counsel of the

Company.

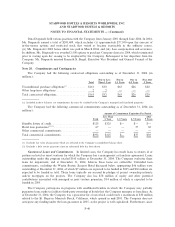

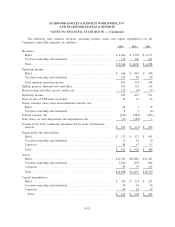

Note 20. Commitments and Contingencies

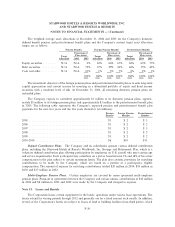

The Company had the following contractual obligations outstanding as of December 31, 2004 (in

millions):

Due in Less Due in Due in Due After

Total Than 1 Year 1-3 Years 4-5 Years 5 Years

Unconditional purchase obligations(a) ÏÏÏÏÏÏÏÏÏÏÏÏ $161 $50 $65 $26 $20

Other long-term obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2 2 Ì Ì Ì

Total contractual obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $163 $52 $65 $26 $20

(a) Included in these balances are commitments that may be satisÑed by the Company's managed and franchised properties.

The Company had the following commercial commitments outstanding as of December 31, 2004 (in

millions):

Amount of Commitment Expiration Per Period

Less Than After

Total 1 Year 1-3 Years 4-5 Years 5 Years

Standby letters of creditÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $125 $125 $Ì $Ì $Ì

Hotel loan guarantees(1)(2)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 67 Ì Ì 37 30

Other commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì Ì Ì

Total commercial commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $192 $125 $Ì $37 $30

(1) Excludes fair value of guarantees which are reÖected in the Company's consolidated balance sheet.

(2) Excludes a debt service guarantee since no substantial debt has been drawn.

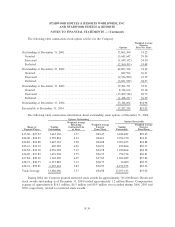

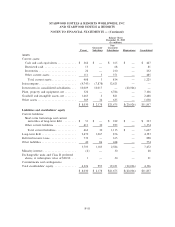

Guaranteed Loans and Commitments. In limited cases, the Company has made loans to owners of or

partners in hotel or resort ventures for which the Company has a management or franchise agreement. Loans

outstanding under this program totaled $160 million at December 31, 2004. The Company evaluates these

loans for impairment, and at December 31, 2004, believes these loans are collectible. Unfunded loan

commitments, excluding the Westin Boston, Seaport Hotel discussed below, aggregating $46 million were

outstanding at December 31, 2004, of which $7 million are expected to be funded in 2005 and $30 million are

expected to be funded in total. These loans typically are secured by pledges of project ownership interests

and/or mortgages on the projects. The Company also has $78 million of equity and other potential

contributions associated with managed or joint venture properties, $34 million of which is expected to be

funded in 2005.

The Company participates in programs with unaÇliated lenders in which the Company may partially

guarantee loans made to facilitate third-party ownership of hotels that the Company manages or franchises. As

of December 31, 2004, the Company was a guarantor for a loan which could reach a maximum of $30 million

related to the St. Regis in Monarch Beach, California, which opened in mid-2001. The Company does not

anticipate any funding under the loan guarantee in 2005, as the project is well capitalized. Furthermore, since

F-46