Starwood 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

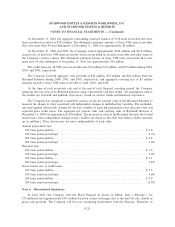

Note 4. Gain (Loss) on Asset Dispositions and Impairments, Net

During 2004, the Company sold two hotels for net proceeds of $56 million. The Company recorded a net

loss of $33 million primarily related to the sale of these hotels, the impairment of one hotel sold in January

2005, and three investments deemed impaired in 2004.

During 2003, the Company recorded a $183 million charge primarily related to the impairment of

18 non-core domestic hotels that were held for sale. The Company sold 16 of these hotels for net proceeds of

$404 million, the majority of which were sold subject to franchise agreements.

In June 2003, the Company also sold a portfolio of assets including four hotels, a marina and shipyard, a

golf club and a 51% interest in its undeveloped land in Costa Smeralda in Sardinia, Italy (""Sardinia Assets'')

for 290 million Euro (approximately $340 million based on exchange rates at the time the sale closed) in gross

cash proceeds. The Company continues to manage the four hotels subject to long-term management contracts.

Accordingly, the results related to the Sardinia Assets prior to the sale date are not classiÑed as discontinued

operations and the gain on sale of approximately $77 million was deferred and is being recognized in earnings

over the 10.5 year life of the management contracts. The Company recorded a $9 million gain on the sale of

the 51% interest in the undeveloped land. This gain was oÅset by a $9 million write down of the value of a

hotel which was formerly operated together with one of the non-core domestic hotels and is now closed and

under review for alternative use and a $2 million charge related to an impairment of an investment.

During 2002, the Company sold two hotels for net proceeds of $51 million. The Company recorded a net

loss on these sales of $3 million in 2002. In September 2002, the Company sold its 2% investment in Interval

International, a timeshare exchange company. The Company received gross proceeds of approximately

$8 million as a result of this sale and recorded a gain of approximately $6 million.

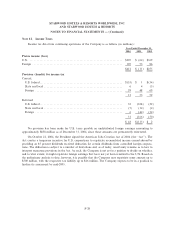

Note 5. Notes Receivable Securitizations and Sales

From time to time, the Company securitizes or sells, without recourse, its Ñxed rate VOI notes receivable.

To accomplish these securitizations, the Company transfers a pool of VOI notes receivable to special purpose

entities (together with the special purpose entities in the next sentence, the ""SPEs'') and the SPEs transfer

the VOI notes receivable to qualifying special purpose entities (""QSPEs''), as deÑned in SFAS No. 140,

""Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities Ì a

Replacement of FASB Statement No. 125.'' To accomplish these sales, the Company transfers a pool of VOI

notes receivable to special purpose entities and the SPEs transfer the VOI notes receivables to a third party

purchaser. The Company continues to service the securitized and sold VOI notes receivable pursuant to

servicing agreements negotiated on an arms-length basis based on market conditions; accordingly, the

Company has not recognized any servicing assets or liabilities. All of the Company's VOI notes receivable

securitizations and sales to date have qualiÑed to be, and have been, accounted for as SFAS No. 140 sales.

With respect to those transactions still outstanding at December 31, 2004, the Company retains economic

interests (the ""Retained Interests'') in securitized and sold VOI notes receivables through SPE ownership of

QSPE beneÑcial interests (securitizations) and the right to a deferred purchase price payable by the

purchaser of the sold VOI notes receivable. The Retained Interest, which is comprised of subordinated

interests and interest only strips in the related VOI notes receivable, provides credit enhancement to the third-

party purchasers of the related QSPE beneÑcial interests (securitizations) and VOI notes receivable (sales).

Retained Interests cash Öows are limited to the cash available from the related VOI notes receivable, after

servicing fees, absorbing 100% of any credit losses on the related VOI notes receivable, QSPE Ñxed rate

interest expense, the third party purchaser's contractual Öoating rate yield (VOI notes receivable sales), and

program fees (VOI note receivables sales).

F-21