Starwood 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

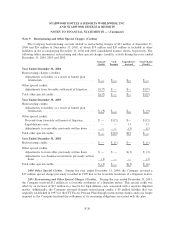

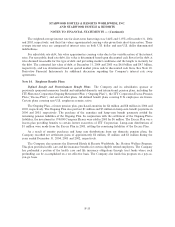

2002 Restructuring and Other Special Credits. During the year ended December 31, 2002, the

Company recorded reversals of restructuring charges of $1 million and reversals of other special charges of

$6 million. The reversal of the restructuring charge relates to an adjustment to the severance liability

established in connection with the cost containment eÅorts following the events of September 11, 2001 based

on actual costs incurred. The reversal of the other special charges primarily related to sales of investments in

certain e-business ventures previously deemed impaired and the collections of receivables which were

previously deemed uncollectible.

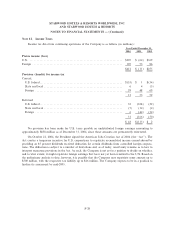

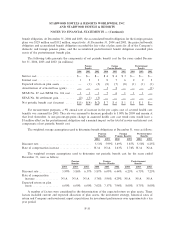

Note 10. Plant, Property and Equipment

Plant, property and equipment consisted of the following (in millions):

December 31,

2004 2003

Land and improvements ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1,337 $ 1,334

Buildings and improvementsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,350 6,193

Furniture, Ñxtures and equipment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,095 1,942

Construction work in process ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 189 217

9,971 9,686

Less accumulated depreciation and amortization ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,974) (2,580)

$ 6,997 $ 7,106

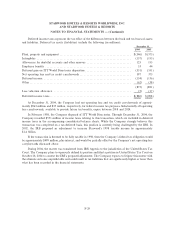

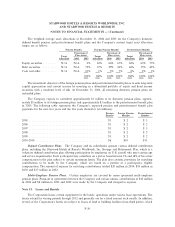

Note 11. Accrued Expenses

Accrued expenses include accrued distributions of $176 million and $172 million at December 31, 2004

and 2003, respectively. Accrued expenses also include the current portion of insurance reserves (as discussed

in Note 20. Commitments and Contingencies), SPG point liability and other marketing accruals and other

restructuring reserves (as discussed in Note 9. Restructuring and Other Special Charges (Credits)).

F-27