Starwood 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

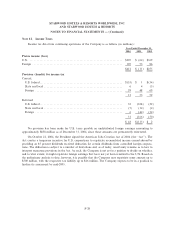

other amendments to clarify the application of the guidance. In adopting FIN 46(R), the Company has

evaluated its various variable interests to determine whether they are in VIE's. These variable interests, which

generally represent modest interests relative to the other investors in the ventures, are primarily related to the

Company's strategy to expand its role as a third-party manager of hotels and resorts, allowing the Company to

increase the presence of its lodging brands and gain additional cash Öow. The evaluation identiÑed the

following types of variable interests: (a) subordinated loans to ventures which have typically taken the form of

Ñrst or second mortgage loans, (b) equity investments in ventures which have typically ranged from 10% to

30% of the equity, (c) guarantees to ventures which have typically related to loan guarantees on new

construction projects that are well capitalized and which typically expire within a few years of the hotels

opening and (d) other types of contributions to ventures owning hotels to secure the management or franchise

contract. The Company also reviewed its other management and franchise agreements related to hotels that

the Company has no other investments in and concluded that such arrangements were not variable interests

since the Company is paid at a level commensurate with the services provided and on the same level as other

operating liabilities and the hotel owners retain the right to terminate the arrangements under certain

circumstances.

Of the nearly 600 hotels that the Company manages or franchises, the Company has identiÑed

approximately 20 hotels that it has a variable interest in. For those ventures that the Company holds a variable

interest, it determined that the Company was not the PB and such VIE's should not be consolidated in the

Company's Ñnancial statements. The Company's outstanding net loan balances exposed to losses as a result of

its involvement in VIE's totaled $75 million and $69 million at December 31, 2004 and 2003, respectively.

Equity investments and other types of investments related to VIE's totaled $34 million and $37 million,

respectively, at December 31, 2004 and $24 million and $21 million, respectively, at December 31, 2003.

Information concerning the Company's exposure to loss on loan guarantees and commitments to fund other

types of contributions is summarized in Note 20. Commitments and Contingencies.

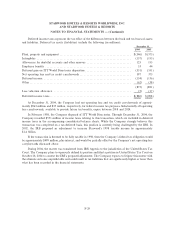

Note 3. SigniÑcant Acquisitions

Acquisition of Sheraton Kauai Resort. In March 2004, the Company acquired the 413-room Sheraton

Kauai Resort on Poipu Beach in Kauai, Hawaii. The purchase price for the property was approximately

$40 million and was funded from available cash. Prior to the acquisition, the Company managed the property

for the former owner.

Tender OÅer to Acquire Partnership Units of Westin Hotels Limited Partnership. In the fourth quarter

of 2003, the Company commenced a tender oÅer to acquire any and all of the outstanding limited partnership

units of Westin Hotels Limited Partnership, the entity that indirectly owns the Westin Michigan Avenue

Hotel in Chicago, Illinois, one of the Company's managed hotels. The tender oÅer expired on February 20,

2004 and approximately 34,000 units were tendered to the Company and accepted for payment, representing

approximately 25% of the outstanding units. The purchase price of approximately $26 million was funded from

available cash.

Acquisition of BlissWorld LLC. In January 2004, the Company acquired a 95% interest in Bliss-

World LLC which, at the time of the acquisition, operated three stand alone spas (two in New York,

New York and one in London, England) and a beauty products business with distribution through its own

internet site and catalogue as well as through third party retail stores. The aggregate purchase price for the

acquired interest was approximately $25 million and was funded from available cash. The Company recorded

approximately $22 million in goodwill associated with this acquisition.

F-20