Starwood 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discussed above, oÅset in part by certain non-recurring increases in selling, general, and administrative costs,

including the accrual, not payment, for separation costs for our Executive Chairman as provided for in his

employment agreement, higher incentive compensation costs commensurate with our improved performance,

certain legal settlement costs, and costs associated with our World Conference in January 2004 (we did not

have a conference in the prior year).

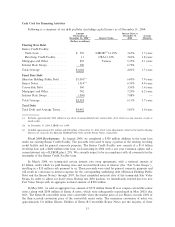

Operating income at our hotel segment was $664 million in the year ended December 31, 2004 compared

to $445 million in the same period of 2003. The improved operating results at our owned, leased and

consolidated joint venture hotels more than oÅset the absence of operating income from the hotels sold in

2003 as discussed above, as well as the increased energy and health insurance costs. Operating income for the

vacation ownership and residential segment was $142 million in the year ended December 31, 2004 compared

to $89 million for the same period in 2003 primarily due to the signiÑcant increase in income from the sales of

VOIs and the percentage of completion accounting methodology discussed above.

Restructuring and Other Special Credits, Net. During the twelve months ended December 31, 2004, we

reversed a $37 million reserve previously recorded through restructuring and other special charges due to a

favorable judgment in a litigation matter. During the twelve months ended December 31, 2003, we received

$12 million in a favorable settlement of a litigation matter. This credit was oÅset by an increase of $13 million

in a reserve for legal defense costs associated with a separate litigation matter. Additionally, we reversed a

$9 million liability that was originally established in 1997 for the ITT Excess Pension Plan and is no longer

required as we Ñnalized the settlement of the remaining obligations associated with the plan and reversed

$1 million related to the collection of receivables previously deemed impaired.

Depreciation and Amortization. Depreciation expense increased $3 million to $413 million during the

year ended December 31, 2004 compared to $410 million in the corresponding period of 2003. This slight

increase was due to additional depreciation expense resulting from capital expenditures at our owned, leased

and consolidated joint venture hotels in the past 12 months. Amortization expense decreased to $18 million in

the year ended December 31, 2004 compared to $19 million in the corresponding period of 2003.

Gain on Sale of VOI Notes Receivable. Gains from the sale of VOI receivables of $14 million and

$15 million in 2004 and 2003, respectively, are primarily due to the sale of $113 million and $181 million of

vacation ownership receivables during the years ended December 31, 2004 and 2003, respectively.

Net Interest Expense. Interest expense, which is net of discontinued operations allocations of $7 million

for the year ended December 31, 2003, decreased to $254 million from $282 million. This decrease was due

primarily to the lower debt balances in 2004 compared to the same period of 2003 as a result of the paydown of

debt in 2003 with the proceeds from asset sales, the payoÅ of the Series B Convertible Senior Notes in 2004,

and the amortization of deferred gains recorded as a result of interest rate swap terminations completed in

early March 2004, oÅset in part by slightly higher interest rates. Our weighted average interest rate was 5.81%

at December 31, 2004 versus 5.46% at December 31, 2003.

Loss On Asset Dispositions and Impairments, Net. During 2004, we recorded a net loss of $33 million

primarily related to the sale of two hotels in 2004, the sale of one hotel in January 2005, and three investments

deemed impaired in 2004.

During 2003, we recorded a $181 million charge related to the impairment of 18 non-core domestic hotels

that were held for sale. We sold 16 of these hotels for net proceeds of $404 million. We also recorded a

$9 million gain on the sale of a 51% interest in undeveloped land in Costa Smeralda in Sardinia, Italy. This

gain was oÅset by a $9 million write down of the value of a hotel which was formerly operated together with

one of the non-core domestic hotels and is now closed and under review for alternative use and a $2 million

charge related to an impairment of an investment.

Discontinued Operations. For the year ended December 31, 2004, the net gain on dispositions includes

$16 million related to the favorable resolution of certain tax matters and $10 million primarily related to the

reversal of reserves, both of which related to our former gaming business which was disposed of in 1999. The

reserves were reversed as the related contingencies were resolved.

26