Starwood 2004 Annual Report Download - page 42

Download and view the complete annual report

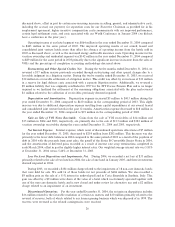

Please find page 42 of the 2004 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.notes to us in May 2004 for a purchase price of approximately $311 million, and in December 2004 we

purchased the remaining $20 million, leaving a zero balance as of December 31, 2004.

Fiscal 2003 Developments. In May 2003, we sold an aggregate of $360 million 3.5% coupon convertible

senior notes due 2023. The notes are convertible, subject to certain conditions, into 7.2 million Shares based

on a conversion price of $50.00 per Share. Gross proceeds received were used to repay a portion of our Senior

Credit Facility and for other operational purposes. Holders may Ñrst present their notes to us for repurchase in

May 2006.

During the second quarter of 2003, we amended our Senior Credit Facility. The amendment adjusted the

leverage coverage ratio for the second quarter of 2003 and for the next eight quarters (through June 30, 2005).

In addition, we modiÑed our current covenant on encumbered EBITDA (as deÑned) and added a restriction

on the level of cash dividends.

Fiscal 2002 Developments. In October 2002, we reÑnanced our previous senior credit facility with a new

four-year $1.3 billion senior credit facility. The new facility is comprised of a $1.0 billion revolving facility and

a $300 million term loan (later increased to $600 million as discussed earlier), each maturing in 2006, with a

one-year extension option, and an initial interest rate of LIBOR ° 1.625%. The proceeds from the new Senior

Credit Facility were used to pay oÅ all amounts owed under our previous senior credit facility, which was due

to mature in February 2003. We incurred approximately $1 million in charges in connection with this early

extinguishment of debt.

In September 2002, we terminated certain Fair Value Swaps, resulting in a $78 million cash payment to

us. These proceeds were used to pay down the previous revolving credit facility and will result in a decrease to

interest expense on the hedged debt through its maturity in 2007. In order to retain our Ñxed versus Öoating

rate debt position, we immediately entered into Ñve new Fair Value Swaps on the same underlying debt as the

terminated swaps.

In April 2002, we sold $1.5 billion of senior notes in two tranches Ì $700 million principal amount of

7

3

/

8

% senior notes due 2007 and $800 million principal amount of 7

7

/

8

% senior notes due 2012. We used the

proceeds to repay all of our senior secured notes facility and a portion of our previous senior credit facility. In

connection with the repayment of debt, we incurred charges of approximately $29 million including

approximately $23 million for the early termination of interest rate swap agreements associated with repaid

debt, and $6 million for the write-oÅ of deferred Ñnancing costs and termination fees associated with the early

extinguishment of debt.

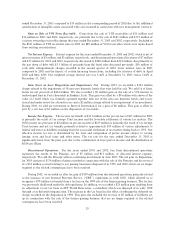

Other. We have approximately $619 million of outstanding debt maturing in 2005. Based upon the

current level of operations, management believes that our cash Öow from operations, together with available

borrowings under the Revolving Credit Facility (approximately $864 million at December 31, 2004), available

borrowings from international revolving lines of credit (approximately $103 million at December 31, 2004),

and capacity for additional borrowings will be adequate to meet anticipated requirements for scheduled

maturities, dividends, working capital, capital expenditures, marketing and advertising program expenditures,

other discretionary investments, interest and scheduled principal payments for the foreseeable future.

However, we have a substantial amount of indebtedness and had a working capital deÑciency of $445 million

at December 31, 2004. There can be no assurance that we will be able to reÑnance our indebtedness as it

becomes due and, if reÑnanced, on favorable terms. In addition, there can be no assurance that our business

will continue to generate cash Öow at or above historical levels or that currently anticipated results will be

achieved.

We maintain non-U.S.-dollar-denominated debt, which provides a hedge of our international net assets

and operations but also exposes our debt balance to Öuctuations in foreign currency exchange rates. During the

years ended December 31, 2004 and 2003, the eÅect of changes in foreign currency exchange rates was a net

increase in debt of approximately $13 million and $54 million, respectively. Our debt balance is also aÅected

by changes in interest rates as a result of our Fair Value Swaps. The fair market value of the Fair Value Swaps

is recorded as an asset or liability and as the Fair Value Swaps are deemed to be eÅective, an adjustment is

recorded against the corresponding debt. At December 31, 2004, our debt included an increase of

34