Square Enix 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 0 6 1

A n n u a l R e p o r t 2 0 0 6

The total amount of undistributed earnings of foreign

subsidiaries for income tax purposes was approximately ¥2,273

million, ¥4,377 million and ¥5,128 million for the years ended

March 31, 2006, 2005 and 2004, respectively. It is the Com-

pany’s intention to reinvest undistributed earnings of its foreign

subsidiaries and thereby indefinitely postpone their remittance.

Accordingly, no provision has been made for the Japanese

income taxes which may become payable if undistributed

earnings of foreign subsidiaries were paid as dividends to

the Company.

1 7 . S t o c k h o ld e r s ’ E q u it y

Merger

On April, 2003, the Company issued 51,167,293 shares of

common stock in exchange for shares of former Square as a

result of the statutory merger. The merger was accounted for

using “ pooling of interest method of accounting” for JCC pur-

poses, and accordingly, the stockholders’ equity of liquidated

Square was combined with that of the Company. The Company

made cash payments to stockholders of former Square in the

total amount of ¥4,153 million in lieu of dividend for the final

year of Square ended March 31, 2003.

Dividend

Both the JCC and the JCL require that dividends declared to be

paid out of retained earnings of the Company and such retained

earnings available for dividend shall be calculated in accordance

with the related JCC or JCL requirements and the JPNGAAP.

Comprehensive Income

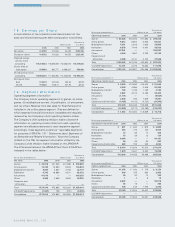

Accumulated other comprehensive (loss) income as of March

31, 2006 and 2005 are as follows:

Thousands of

Millions of yen U.S. dollars

2006 2005 2006

Foreign currency translation adjustments:

Balance, beginning of year ¥ (907) ¥(956) $(7,731)

Aggregate adjustment for the year

resulting from translation of foreign

currency financial statements 963 49 8,195

Balance, end of year ¥0,056 ¥(907) $(0,464

Net unrealized gains on

available-for-sale securities:

Balance, beginning of year ¥0,428 ¥(319 $(3,650

Net increase 59 109 505

Balance, end of year ¥0,487 ¥(428 $(4,155

Total accumulated other

comprehensive income:

Balance, beginning of year ¥ (479) ¥(637) $(4,081)

Adjustments for the year 1,022 158 8,700

Balance, end of year ¥0,543 ¥(479) $(4,619

Tax effects allocated to each component of other compre-

hensive income (loss) and adjustments are as follows:

Millions of yen

Pretax Tax benefit Net of tax

2006 amount (expense) amount

Foreign currency translation

adjustments ¥963 ¥— ¥963

Net unrealized gain on

available-for-sale securities:

Unrealized gain arising during

the year 145 86 59

Less: reclassification for gain

included in net income ———

Net unrealized gain ¥145 ¥86 ¥059

Thousands of U.S. dollars

Pretax Tax benefit Net of tax

2006 amount (expense) amount

Foreign currency translation

adjustments $8,195 — $8,195

Net unrealized gain on

available-for-sale securities:

Unrealized gain arising during

the year 1,242 737 505

Less: reclassification for gain

included in net income ———

Net unrealized gain $1,242 $737 $0,505

Millions of yen

Pretax Tax benefit Net of tax

2005 amount (expense) amount

Foreign currency translation

adjustments ¥049 — ¥049

Net unrealized gain on

available-for-sale securities:

Unrealized gain arising during

the year 268 ¥159 109

Less: reclassification for gain

included in net income — — —

Net unrealized gain ¥268 ¥159 ¥109

Millions of yen

Pretax Tax benefit Net of tax

2004 amount (expense) amount

Foreign currency translation

adjustments ¥(999) — ¥(999)

Net unrealized gain (loss) on

available-for-sale securities:

Unrealized gain (loss) arising during

the year 539 ¥220 319

Less: reclassification for gain (loss)

included in net income (39) (16) (23)

Net unrealized gain (loss) ¥(500 ¥204 ¥(296