Square Enix 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 6 1 7

A n n u a l R e p o r t 2 0 0 6

Rental Deposits

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥2,863 ¥17,361 ¥14,498 ¥14,443

Claims in Bankruptcy

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥— ¥2,240 ¥2,240 ¥2,240

Construction Cooperation Fund

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥— ¥2,158 ¥2,158 ¥2,158

Allowance for Doubtful Accounts

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥— ¥(4,738) ¥(4,738) ¥(4,738)

Among investments and other assets, rental deposits, claims in

bankruptcy and reorganization proceedings, construction coopera-

tion fund and provision for doubtful accounts all increased owing

to Taito becoming a consolidated subsidiary. Rental deposits and

the construction cooperation fund are mainly related to the lease of

game center facilities. Claims in bankruptcy and reorganization pro-

ceedings are mainly attributable to a claim against Baltec Co., Ltd.,

an equity-method affiliate. Provision for doubtful accounts is mainly

related to reserves provided for receivables from Baltec and rental

deposits for leases of game center facilities.

L ia b ilit ie s

Total Liabilities

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥22,103 ¥91,234 ¥69,131 ¥89,323

Total liabilities as of March 31, 2006, amounted to ¥91,234 million,

an increase of ¥69,131 million compared with the previous fiscal

year-end. The major factors contributing to this change are as

follows. (Note: Taito includes payables related to the merger of

¥66,999 million.)

Notes and Accounts Payable

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥2,241 ¥12,124 ¥9,882 ¥8,433

Notes and accounts payable increased ¥9,882 million, to ¥12,124

million, mainly owing to Taito becoming a consolidated subsidiary

and the timing of game title releases near the end of the period.

Accrued Expenses

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥1,662 ¥6,413 ¥4,750 ¥4,422

Accrued expenses increased ¥4,750 million, to ¥6,413 million,

mainly owing to Taito being made a consolidated subsidiary.

Other Accounts Payable

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

¥1,190 ¥6,509 ¥5,318 ¥67,760

Mainly owing to payables relating to the merger and takeover of

Taito, namely outstanding payables to minority interests in Taito,

other accounts payable increased ¥5,318 million, to ¥6,509 million.

Among Taito’s other accounts payable shown above, the amount

of payables relating to the merger with SQEX, which was payable

to the Company, was offset through consolidation. (Note: Taito

includes payables relating to the merger totaling ¥66,999 million.)

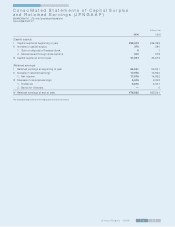

S h a r e h o ld e r s ’ E q u it y

Years ended March 31 Millions of yen

2005 2006 Change

Common stock ¥007,433 ¥007,803 ¥00,370

Capital surplus reserve 36,673 37,044 370

Retained earnings 65,561 76,022 10,460

Unrealized gain on revaluation of

other investment securities 472 531 59

Foreign currency translation

adjustment (807) 97 904

Treasury stock (401) (506) (104)

Total shareholders’ equity ¥108,933 ¥120,993 ¥12,060

As of March 31, 2006, total shareholders’ equity amounted to

¥120,993 million, an increase of ¥12,060 million compared to the

previous fiscal year-end. The increases in common stock and capital

reserve are due to stock options being exercised.

Total shareholders’ equity as of March 31, 2006, was not

affected by the takeover of Taito—excluding consolidated income

effects in the second half of the period—since the Company did

not use treasury stock in the takeover transaction. Consequently,

compared with the previous fiscal year-end, the ¥10,460 million

increase in retained earnings is the main factor contributing to the

increase in total shareholders’ equity.