Square Enix 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

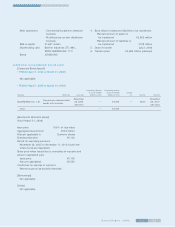

6. Redemption schedule of other securities with a maturity

date on those to be held to maturity

Not applicable

D e r iv a t iv e T r a n s a c t io n s

• FY2004 (April 1, 2004 to March 31, 2005)

1. Condition of transaction

(1) Type of transaction and purpose

The Company does not engage in derivative transactions in

principal, however, the Company enters into foreign

exchange forward contracts to reduce the effect of fluctua-

tions in foreign currencies.

(2) Transaction policy

The Company enters into foreign exchange forward con-

tracts to cover anticipated transactions denominated in for-

eign currencies but does not enter into these contracts for

speculation.

(3) Risks

Foreign exchange forward contracts include the market risk

of fluctuations in foreign currencies but in our estimation,

the risk of nonperformance is considered to be low as the

contracts are entered into with prestigious financial institu-

tions.

(4) Risk Management

Contracts are approved by the representative director and

executive director in charge, and the Accounting and

Financing Division administer the risk management.

2. Market value of transaction

Not applicable

• FY2005 (April 1, 2005 to March 31, 2006)

1. Condition of transaction

(1) Type of transaction and purpose

Same as FY2004

(2) Transaction policy

Same as FY2004

(3) Risks

Same as FY2004

(4) Risk Management

Same as FY2004

2. Market value of transaction

Not applicable

R e t ir e m e n t B e n e f it s

• FY2004 (April 1, 2004 to March 31, 2005)

1. Overview of retirement benefit plan applied

The Company and its domestic consolidated subsidiaries

applied a lump-sum retirement payment plan with regard

to its retirement benefit obligation.

The projected benefits are allocated to periods of service

on a straight-line basis. The Company’s domestic consoli-

dated subsidiaries apply the conventional method in the

calculation of retirement benefit obligations. In addition,

certain of the Company’s overseas subsidiaries maintain

defined contribution retirement pension plans.

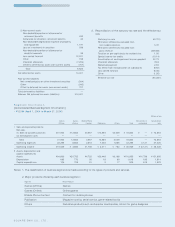

2. Retirement benefit obligation:

Millions of yen

Retirement benefit obligation ¥0,969

Net unfunded obligation 969

Unrecognized prior service cost 100

Unrecognized actuarial loss 103

Allowance for retirement benefits ¥1,173

3. Retirement benefit expenses:

Millions of yen

Service cost ¥210

Interest cost 15

Amortization of net actuarial gains and losses 10

Retirement benefit expenses ¥235

4. Assumption used in accounting for retirement benefit

obligation:

Periodic allocation method for projected benefits Straight-line basis

Discount rate 1.652%

Years over which prior service costs are amortized 1 year

Years over which net actuarial gains and losses

are amortized 1 year

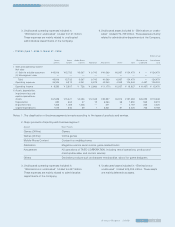

• FY2005 (April 1, 2005 to March 31, 2006)

1. Overview of retirement benefit plan applied

The Company and its domestic consolidated subsidiaries

applied a lump-sum retirement payment plan with regard

to its retirement benefit obligation.

The projected benefits are allocated to periods of service

on a straight-line basis. The Company’s domestic consoli-

dated subsidiaries apply the conventional method in the

calculation of retirement benefit obligations. In addition,

certain of the Company’s overseas subsidiaries maintain

defined contribution retirement pension plans.