Square Enix 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

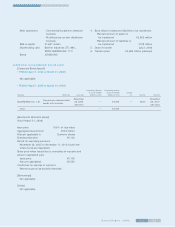

S Q U A R E E N IX C O . , L T D .

Concentration of Credit Risk

If the financial condition and operations of the Company’s

customers deteriorate, the risk of collection could increase

substantially. As of March 31, 2006 and 2005, the receivable

balances from the Company’s five largest customers amounted

to approximately 22.5% and 60.1% of the Company’s net

accounts and notes receivable balance, respectively. For the

years ended March 31, 2006, 2005 and 2004, the Company’s

five largest customers accounted for 13.3% , 25.4% , and

21.6% of net sales, respectively. The Company sets the credit

limit to each customer and monitors its solvency continuously.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased

with original maturities of three months or less to be cash

equivalents.

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, accounts

and notes receivable, accounts and notes payable and accrued

expenses and approximate fair value because of their short

maturity. Investments in marketable securities are stated at their

fair value based on quoted market prices. Investments in non-

marketable securities for which there are no quoted market

price are stated at cost because reasonable estimates of their

fair value could not be made without incurring excessive costs

and it was not practicable to estimate their fair value of com-

mon stock representing certain closely held companies. The

face value of long-term debt approximates its fair value because

the debt is with zero coupon and the difference between its

face value and the greater of its straight bond value or conver-

sion value constitutes a premium of the embedded conversion

right therein provided by the debt holder. The carrying amount

of the Company’s lines of credit approximates fair value

because the interest rates of the lines of credit are based on

floating rates identified by reference to market rates.

Fair value estimates are made at a specific point in time,

based on relevant market information and information about

the financial instruments. These estimates are subjective in

nature and involve uncertainties and matters of significant

judgment and therefore cannot be determined with precision.

Changes in assumptions could significantly affect the estimates.

Inventories

Inventories are stated at the lower of cost or market. The Com-

pany periodically evaluates the carrying value of its inventories

and makes adjustments as necessary. Cost is determined

primarily by the monthly average method for finished goods,

merchandise and work in progress, by the specific identification

method for amusement equipment and, by the last purchase

price method for other supplies.

Software Development Costs

The Company applies Statement of Financial Accounting Stan-

dards (“ SFAS” ) No.86, “ Accounting for the Cost of Computer

Softw are to be Sold, Leased, or Otherw ise M arketed” , pursuant

to which, the Company capitalizes internal software develop-

ment cost, as well as content cost, subsequent to establishment

of technological feasibility of certain video game software.

Capitalized software development costs on the accompanying

consolidated balance sheets include the payment to an outside

independent contactor as well as costs associated with internal

development of the video game products. Software develop-

ment costs are amortized as a component of “ Cost of sales”

over the expected life of each video game product, starting

from its initial delivery to the market. The Company continually

evaluates the recoverability of capitalized software costs and will

charge to earnings any amounts that are deemed unrecoverable

or for projects that it will abandon.

Property and Equipment

Depreciation of property and equipment is computed on the

declining-balance method for the Company and domestic sub-

sidiaries, and the straight-line method for foreign subsidiaries

over the estimated useful lives of the assets, ranging from 3 to

65 years for buildings, 3 to 15 years for machinery and equip-

ment, and 3 to 8 years for amusement equipment. The cost

of additions and betterments are capitalized, and repairs and

maintenance costs are charged to earnings in the periods

incurred. When depreciable assets are retired or sold, the cost

and related allowances for depreciation are removed from the

accounts and the gain or loss is recognized.

Intangible Assets

Intangible assets consist of identifiable intangibles and the

remaining excess purchase price paid over identified intangible

and tangible net assets of acquired companies (goodwill). The

Company applies the provisions of SFAS No. 141, “ Business

Combinations” in its entirety and SFAS No. 141 requires all busi-

ness combinations be accounted for using the purchase method

of accounting and that certain intangible assets acquired in a

business combination shall be recognized as assets apart from

goodwill. SFAS No. 142, “ Goodw ill and Other Intangible Assets”

addresses the recognition and measurement of goodwill and

other intangible assets subsequent to their acquisition. SFAS

No. 142 provides that intangible assets with finite useful lives

be amortized and that intangible assets with indefinite lives and

goodwill not be amortized but tested for impairment annually.

SFAS No. 142 requires an annual test for impairment of

goodwill, and between annual tests if events occur or circum-

stances change that would more likely than not reduce the fair

value of a reporting unit below its carrying amount. In assessing

potential impairment of goodwill, the Company determines the