Square Enix 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5 4 5 5

A n n u a l R e p o r t 2 0 0 6

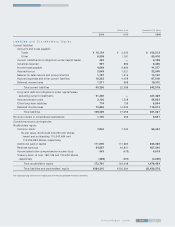

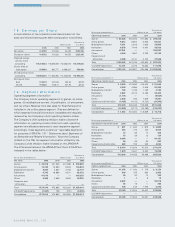

The following table sets forth the components of the purchase

price of the UIEvolution acquisition:

Millions of yen

Cost of the acquisition:

Cash, net of cash acquired ¥6,091

Total ¥6,091

Allocation of purchase price:

Property and equipment ¥0,010

Existing technology (useful life of 5 years) 2,853

Trade name and trade marks (useful life of 5 years) 401

Customer contracts (useful life of 2 years) 243

Goodwill 3,331

Net other liabilities (747)

Total ¥6,091

Acquisition of TAITO

On September 28, 2005, the Company acquired 93.7% of

outstanding shares of stock of Taito by a cash tender offer. Per

share price offered to the shareholders of Taito was ¥181,100

each. Following the acquisition of 93.7% stake in Taito, the

Company engaged in the minority cash-out transaction in

March 2006 in order for Taito to become a wholly owned

subsidiary of the Company. In a series of these transactions,

the aggregate purchase price, including assumption of liabilities,

was ¥87,145 million. The acquisition has been accounted for

as a purchase business combination in accordance with SFAS

No.141 and, accordingly, the result of operations and financial

position of the acquired business are included in the Company’s

consolidated financial statement from the dates of acquisition.

The balance of the purchase price in excess of the fair value of

the assets acquired and that of intangible assets acquired at the

date of acquisition was recorded as goodwill totaling ¥21,502

million, none of which is expected to be deductible for tax pur-

poses. The Company’s consolidated results of operations for the

year ended March 31, 2006 reflected Taito’s operating activities

for the period from September 28, 2005 (the date of acquisition)

to March 31, 2006.

The following table sets forth the components of the purchase

price of the Taito acquisition:

Thousands of

Millions of yen U.S. dollars

Cost of the acquisition:

Cash, net of cash acquired ¥53,144 $452,405

Liabilities assumed 34,001 289,444

Total ¥87,145 $741,849

Allocation of purchase price:

Current assets ¥16,841 $143,364

Non-current assets 42,994 365,997

Database (indefinite useful life) 1,449 12,335

Trademarks (useful life of 1.5 years) 232 1,975

Business license (useful life of 3.5 years) 2,046 17,417

Copyrights (useful life of 1 year) 2,081 17,715

Goodwill 21,502 183,046

Total ¥87,145 $741,849

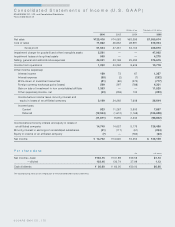

Unaudited Pro Forma Information

The unaudited pro forma data below for the years ended March

31, 2006, 2005, and 2004 are presented as if the acquisitions

of UIEvolution and Taito had taken place on April 1, 2003. The

unaudited pro forma financial information is based on man-

agement’s estimates and assumptions and does not purport to

represent the results that actually would have occurred if the

acquisitions had, in fact, been completed on the dates

assumed, or which may result in the future.

Thousands of

Millions of yen U.S. dollars

(Except share data)

Years ended March 31

2006 2005 2004 2006

Total revenue ¥164,902 ¥158,623 ¥145,386 $1,403,779

Income before

income taxes ¥3,763 ¥26,753 ¥7,137 $32,033

Net income ¥13,692 ¥16,102 ¥4,422 $116,557

Net income per share

—Basic ¥124.00 ¥146.26 ¥40.19 $1.055

Net income per share

—Diluted ¥123.36 ¥144.99 ¥38.57 $1.050

6 . E q u it y In v e s t m e n t in t h e A f f ilia t e d

C o m p a n y

The Company had an equity interest of 26.54% in DigiCube

Co., Ltd., a domestic video game whole-seller devoted to the

convenience store market, listed on the Hercules market of

Osaka Securities Exchange, and accounted for using the equity

method. DigiCube went bankrupt in November 2003, and the

Company recognized an impairment loss on its investment in

DigiCube in the amount of ¥760 million. The bankruptcy

proceeding was closed on April 25th, 2006. Equity method of

accounting was no longer applied for the years ended March

31, 2006 and 2005.

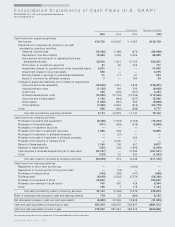

7 . In v e n t o r ie s

As of March 31, 2006 and 2005, inventories consist of:

Thousands of

Millions of yen U.S. dollars

2006 2005 2006

Finished goods and merchandise ¥3,602 ¥0,938 $30,667

Work in progress 1,050 99 8,939

Raw materials 1,319 —11,227

Other supplies 59 76 501

Total ¥6,030 ¥1,113 $51,334