Square Enix 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

Rent expense is recognized on a straight-line basis over the

lease periods. Rent expense under all operating leases was

approximately ¥8,305 million for the year ended March 31, 2006.

The Company is involved in routine litigation in the ordinary

course of its business, which in management’s opinion, will not

have a material adverse effect on the Company’s financial

condition, cash flows or results of operations.

1 4 . E m p lo y e e B e n e f it P la n a n d R e t ir e -

m e n t B e n e f it t o D ir e c t o r s a n d

S t a t u t o r y A u d it o r s

Employee Benefit Plan

The Company has defined benefit plans covering their domestic

employees, which are internally funded. The benefits are in the

form of lump-sum payment and are based on current basic rate

pay applicable to former Enix employees and the highest basic

rate pay until present applicable to former Square employees.

For the new employees hired by the Company on and after

April 1, 2003, the current basic rate pay is applicable to the

basis of benefit. Effective April 1, 2005, the Company changed

its plan policy, in which the benefit is defined as the accumula-

tion of the product of base-pay and certain point earned in

each year of service until termination.

The Company adopted SFAS No. 87 “ Employers’ Accounting

for Pensions” for its domestic defined benefit plans effective

April 1, 2002. A portion of the transitional obligation was

allocated and charged directly to equity on the adoption date.

The Company took over benefit obligation in the amount

of $10,479 million from Taito as a result of its acquisition taken

place in September 2005. Taito has adopted a defined benefit

obligation plan to meet future retirement obligation for its

employees, and the plan has been externally funded. As of March

31, 2006, the plan asset has its fair value of $10,623 million.

Certain U.S. and U.K. subsidiaries have defined contribution

plans for their employees and the contributions are charged to

earnings when incurred. No pension plan is provided for the

employees of the Chinese subsidiary.

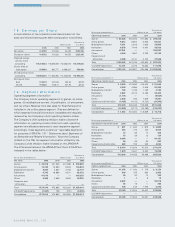

Net periodic pension cost of the Company and its domestic

subsidiaries for the year ended March 31, 2006, 2005 and 2004

consist of the following:

Thousands of

Years ended March 31 Millions of yen U.S. dollars

2006 2005 2004 2006

Service cost ¥356 ¥214 ¥227 $3,028

Interest cost 88 16 8 749

Expected return on plan assets (145) ——(1,230)

Amortization of actuarial loss (7) —— (59)

Amortization of prior

service cost (101) ——(858)

Amortization of SFAS No. 87

transition obligation 322 23

Net periodic pension cost ¥194 ¥232 ¥237 $1,653

Reconciliations of beginning and ending balances of the

pension benefit obligations and the fair value of the plan assets

are as follows:

Thousands of

As of March 31 Millions of yen U.S. dollars

2006 2005 2006

Change in benefit obligation:

Benefit obligation at beginning

of year ¥00,968 ¥(0,983 $(08,253

Service cost 356 214 3,028

Interest cost 88 16 749

Benefit obligation transferred from

acquired company 10,479 —89,203

Prior service costs —(101) —

Actuarial gain (200) (104) (1,706)

Benefits paid (219) (40) (1,868)

Benefit obligation at end of year ¥11,472 ¥(0,968 $(97,659

Change in plan assets:

Fair value of plan assets at

beginning of year ———

Plan assets transferred from

acquired company 8,253 —70,260

Actual return on plan assets 2,077 —17,677

Employer contributions 475 —4,045

Benefits paid (182) —(1,551)

Fair value of plan assets at end

of year 10,623 —90,431

Funded status (849) (968) (7,228)

Unrecognized actuarial loss (gain) (2,306) (180) (19,625)

Unrecognized prior service costs —(101) —

Unrecognized FAS87 transition obligation 19 21 161

Net amount recognized ¥ (3,136) ¥(1,228) $(26,692)

Accumulated benefit obligation at end

of year ¥10,868 ¥845 $(92,517

Actuarial assumption:

Discount rate 1.680~ 1.652% 1.680~

1.837% 1.837%

Assumed rate of increase in

compensation level 3.900~ 4.101% 3.900~

4.101% 4.101%