Square Enix 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

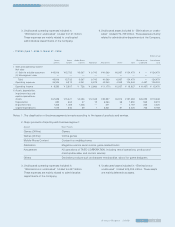

6 . A m o r t iz a t io n o f G o o d w ill

• FY2004 (April 1, 2004 to March 31, 2005)

Goodwill is amortized over a period of 3–5 years on a straight-

line basis.

• FY2005 (April 1, 2005 to March 31, 2006)

Goodwill is amortized over 5 years or 20 years on a straight-line

basis.

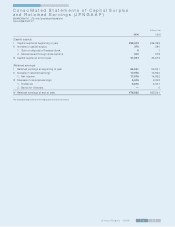

7 . A p p r o p r ia t io n o f R e t a in e d E a r n in g s

• FY2004 (April 1, 2004 to March 31, 2005)

The consolidated statement of capital surplus and retained

earnings is prepared based on earnings (deficit) appropriations

determined during the fiscal year.

• FY2005 (April 1, 2005 to March 31, 2006)

Same as FY2004

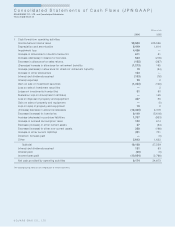

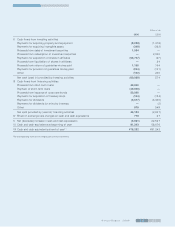

8 . S c o p e o f C a s h a n d C a s h E q u iv a le n t s in t h e

S t a t e m e n t s o f C a s h F lo w s

• FY2004 (April 1, 2004 to March 31, 2005)

Cash and cash equivalents in the consolidated statements of

cash flows is comprised of cash on hand, bank deposits which

are able to be withdrawn on demand and highly liquid short-

term investments with an original maturity of three months or

less and with minor risk of significant fluctuations in value.

• FY2005 (April 1, 2005 to March 31, 2006)

Same as FY2004

N e w A c c o u n t in g S t a n d a r d s

• FY2004 (April 1, 2004 to March 31, 2005)

—————

• FY2005 (April 1, 2005 to March 31, 2006)

(Accounting standard for impairment of non-current assets)

Effective from this fiscal year, the Company has applied the

Accounting Standard for the Impairment of Fixed Assets—

(Opinion Concerning Establishment of Accounting Standard for

the Impairment of Fixed Assets [Business Accounting Council,

August 9, 2002]) and Implementation Guidance for the

Accounting Standard for Impairment of Fixed Assets (Financial

Accounting Standard Implementation Guidance No. 6

[Accounting Standards Board of Japan, October 31, 2003]). As

a result, income before income taxes decreased ¥4,426 million

in this fiscal year. The effect of the new accounting standard on

segment information has been reflected wherever relevant. The

cumulative amount of impairment loss was deducted directly

from the book value of each asset in accordance with the

amended consolidated accounting policy.

R e c la s s if ic a t io n s

• FY2004 (April 1, 2004 to March 31, 2005)

(Consolidated Balance Sheets)

“ Goodwill,” which was included in “ Intangible assets” in the

previous fiscal year, is presented separately in the current year as

the amount became material. In the previous year, “ Goodwill”

included in “ Intangible assets” was ¥6,361 million.

• FY2005 (April 1, 2005 to March 31, 2006)

(Consolidated Balance Sheets)

—————

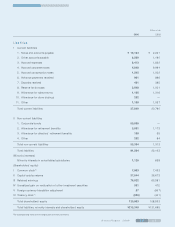

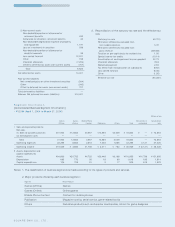

N o t e s t o C o n s o lid a t e d B a la n c e S h e e t s

• FY2004 (April 1, 2004 to March 31, 2005)

*1 Investment in non-consolidated subsidiaries and affiliates:

Investment securities ¥151 million

Investments and other assets ¥4 million

*2 Number of shares of common stock outstanding:

Common stock 110,385,543

*3 Number of shares of treasury stock:

Common stock 150,650

*4 Contingent liabilities for guarantees:

The Company has issued a revolving guarantee to a maxi-

mum limit of U.S.$15 million on behalf of consolidated

subsidiary SQUARE ENIX, INC., in favor of SONY COMPUTER

ENTERTAINMENT AMERICA INC. As of March 31, 2005,

there is no liability outstanding under the guarantee.

• FY2005 (April 1, 2005 to March 31, 2006)

*1 Investment in non-consolidated subsidiaries and affiliates:

Investment securities ¥35 million

Investments and other assets ¥24 million

*2 Number of shares of common stock outstanding:

Common stock 110,729,623

*3 Number of shares of treasury stock:

Common stock 182,139

*4 Contingent liabilities for guarantees:

The Company has issued a revolving guarantee to a maximum

limit of U.S.$15 million on behalf of consolidated subsidiary