Square Enix 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

Because the conversion right embedded in convertible deben-

ture is not detachable from the debenture and is not purported

to convert the debenture into financial instruments other than

the Company’s common stock, the Company does not value the

embedded conversion right as derivative instrument separable

from the debenture for fiscal year of 2006.

Comprehensive Income (Loss)

Comprehensive income (loss) represents change in net assets

of a business enterprise during a period from transactions and

other events and circumstances from non-owner sources.

Comprehensive income (loss) of the Company includes net

income adjusted for the change in foreign currency translation

adjustments and the change in net unrealized gains (losses)

from investments.

Foreign Currency Translation and Transactions

The functional currency for the Company’s foreign operations

is the applicable local currency. Accounts of foreign operations

are translated into Japanese yen using period-end exchange

rates for assets and liabilities at the balance sheet date and

average prevailing exchange rates for the period for revenue

and expense accounts. Adjustments resulting from translation

are included in other comprehensive income (loss). Realized and

unrealized transaction gains and losses are included in income

in the period in which they occur.

Reclassifications

Certain prior year amounts have been reclassified to conform to

current year presentation.

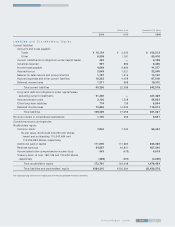

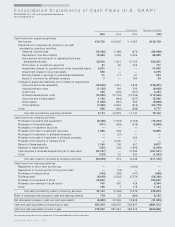

4 . S u p p le m e n t a l D is c lo s u r e s t o C o n s o l-

id a t e d S t a t e m e n t s o f C a s h F lo w s

Thousands of

Millions of yen U.S. dollars

Years ended March 31

2006 2005 2004 2006

Cash payment for interest ¥00,030 —¥0,011 $000,260

Cash payment for

income taxes ¥10,054 ¥2,768 ¥4,797 $085,591

Cash acquisition of

a new subsidiary:

Fair value of assets,

net of cash acquired ¥67,013 ¥3,507 — $570,465

Liabilities assumed (35,371) (747) — (301,106)

Goodwill 21,502 3,331 — 183,046

Cash paid, net of

cash acquired ¥53,144 ¥6,091 — $452,405

5 . B u s in e s s C o m b in a t io n s

Acquisition of SQUARE

On April 1, 2003, the Company acquired all outstanding shares

of SQUARE CO., LTD., a video game developer in Japan, in the

form of a statutory merger. The aggregate purchase price,

including assumption of liabilities and issuance of 51,167,293

shares of common stock was ¥117,131 million. The value of

the Company’s common stock issued in connection with this

acquisition was based on the market price of the Company’s

common stock shortly before and after the date such proposed

transaction was agreed and announced. The acquisition has

been accounted for as a purchase business combination in

accordance with SFAS No. 141 and, accordingly, the result of

operations and financial position of the acquired business are

included in the Company’s consolidated financial statement

from the dates of acquisition. The balance of the purchase price

in excess of the fair value of the assets acquired and the liabilities

assumed at the date of acquisition was recorded as goodwill

totaling ¥35,624 million, none of which is expected to be

deductible for tax purposes. The amount of purchased in-process

research and development assets was ¥12,728 million. Of this,

¥4,862 million was charged to cost of sales during the year

ended March 31, 2004.

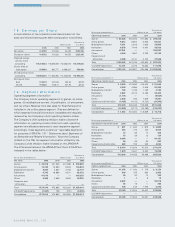

The following table sets forth the components of the

purchase price of the SQUARE acquisition:

Millions of yen

Cost of the acquisition:

Value of stock issued ¥100,807

Liabilities assumed 16,324

Total ¥117,131

Allocation of purchase price:

Current assets ¥049,973

Non-current assets 8,012

Trademarks (indefinite useful life) 10,300

Licensing agreement (indefinite useful life) 9,710

Existing online game (useful life of 12 years) 12,850

Existing offline games and other

(useful life ranging from 1 to 5 years) 3,130

Goodwill 35,624

Net deferred tax liabilities (12,468)

Total ¥117,131

Acquisition of UIEvolution

On March 24, 2004, the Company acquired all of the outstand-

ing preferred and common stock of UIEvolution, Inc. (“ UIEvolu-

tion” ), a Seattle-based middleware development company for

approximately $58 million. This transaction was accounted for

as a purchase business combination and included in the Com-

pany’s operations since the date of acquisition. The balance of

the purchase price in excess of the fair value of the assets

acquired and the liabilities assumed at the date of acquisition

was recorded as goodwill totaling ¥3,331 million, none of

which is expected to be deductible for tax purposes. The Com-

pany’s consolidated results of operations for the year ended

March 31, 2004 reflected UIEvolution’s operating activities for

the period from March 24, 2004 (the date of acquisition) to

March 31, 2004.