Square Enix 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5 2 5 3

A n n u a l R e p o r t 2 0 0 6

In June 2005, the stockholders of the Company approved

the Company’s Stock Option Plan, pursuant to which, officers,

directors, employees of the Company may purchase up to an

aggregate of 909,000 shares of common stock. This plan

expires in the year of 2010.

As of March 31, 2006, 2005 and 2004, the plans had out-

standing stock options totaling 3,418,710, 3,258,775 and

3,262,645 shares of the Company’s common stock, respectively.

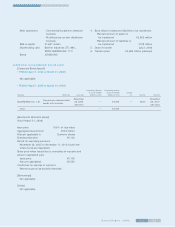

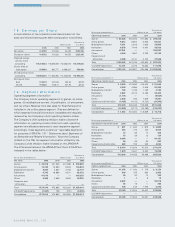

The following table summarizes the activities in options

under the plans:

Weighted-

Number average

of shares exercise price

Options outstanding—March 31, 2004 3,262,645 ¥3,001.17

Granted—exercise price equal to fair value 580,000 2,981.00

Granted—exercise less than fair value — —

Exercised 255,125 2,186.14

Forfeited 328,745 2,964.57

Options outstanding—March 31, 2005 3,258,775 ¥3,065.08

Granted—exercise price equal to fair value 909,000 3,364.96

Granted—exercise less than fair value — —

Exercised 344,080 2,152.00

Forfeited 404,985 7,318.47

Options outstanding—March 31, 2006 3,418,710 ¥2,732.85

At March 31, 2006, 2005 and 2004, the number of options

exercisable was 346,242, 660,595 and 723,397, respectively,

and their related weighted average exercise prices were

¥2,732.85, ¥3,065.08 and ¥3,001.17, respectively.

Had compensation cost for the Company’s stock option

plan been determined based on the fair value at the grant date

for awards in 2006, 2005 and 2004, consistent with the provi-

sions of SFAS No.123, the Company’s net income and the net

income per share would have been reduced to the pro forma

amounts indicated below.

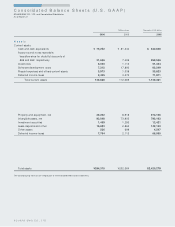

Thousands of

Millions of yen U.S. dollars

(Except share data)

Years ended March 31

2006 2005 2004 2006

Net income:

As reported ¥14,702 ¥14,520 ¥4,355 $125,159

Deduct: Total stock-based

employee compensation

expense determined

under fair value based

method for all awards 716 387 — 6,096

Pro forma net income ¥13,986 ¥14,133 ¥4,355 $119,063

Earnings per share:

As reported—Basic ¥133.15 ¥131.89 ¥39.58 $1.13

Pro forma—Basic 126.67 128.38 — 1.08

As reported—Diluted ¥132.46 ¥130.74 ¥37.99 $1.13

Pro forma—Diluted 126.01 127.26 — 1.07

The pro forma disclosures shown are not representative of

the effects on net income and the net income per share in

future years.

The fair value of the Company’s stock options used to com-

pute pro forma net income and the net income per share dis-

closures is the estimated present value at the grant date using

the Black-Scholes option-pricing model. The weighted average

fair values of options granted were ¥787.67 and ¥666.56 for

the years ended March 31, 2006 and 2005, respectively. The

following weighted average assumptions for the years ended

March 31, 2006 and 2005 were used to value grants, respec-

tively: expected volatilities of 32.16 and 28.33 percent; risk-free

interest rates of 0.524 and 0.715 percent; and expected holding

periods of 4.9 and 4.8 years.

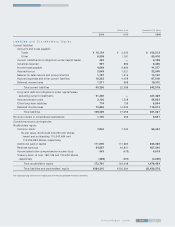

Earnings Per Share

Basic earnings per share (“ EPS” ) are computed by dividing the

net income (loss) applicable to common stockholders for the

year by the weighted-average number of common shares out-

standing during the year. Diluted EPS is computed by dividing

the net income (loss) applicable to common stockholders for

the year by the weighted-average number of common and

common stock equivalents, which include common shares

issuable upon the exercise of stock options outstanding during

the year. Common stock equivalents are excluded from the

computation if their effect is antidilutive.

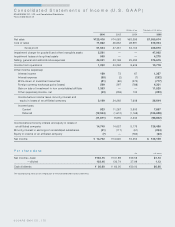

Derivative Instruments

The Company adopted SFAS No. 133, “ Accounting for Deriva-

tive Instruments and Hedging Activities,” as amended by SFAS

No. 138, “ Accounting for Certain Derivative Instruments and

Certain Hedging Activities—an amendment of FASB Statement

No. 133,” and by SFAS No. 149, “ Amendment of SFAS No. 133

on Derivative Instruments and Hedging Activities.” Under SFAS

No. 133, all derivative instruments are recognized in the balance

sheet at their fair values and changes in fair value are recog-

nized immediately in earnings, unless the derivatives qualify

as hedges of future cash flows. For derivatives qualifying as

hedges of future cash flows, the effective portion of changes

in fair value is recorded in other comprehensive income, then

recognized in earnings along with the related effects of the

hedged items. Any ineffective portion of hedges is reported

in earnings as it occurs.

Derivative instruments to be utilized by the Company are

forward exchange contracts and currency options. The Com-

pany uses derivatives for hedging purpose only and does not

intend to hold or issue derivative financial instruments for trad-

ing purposes. No material derivatives were used for the years

ended March 31, 2006, 2005 and 2004.