Square Enix 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

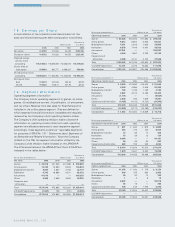

Income tax expenses are as follows:

Thousands of

Years ended March 31 Millions of yen U.S. dollars

2006 2005 2004 2006

Current: ¥(00,923 ¥11,267 ¥(3,600 $(007,857

Domestic (638) 10,350 1,723 (5,434)

Foreign 1,561 917 1,877 13,291

Deferred: ¥(12,534) ¥ (1,612) ¥(1,168) $(106,699)

Domestic (11,982) (1,807) (1,234) (101,999)

Foreign (552) 195 66 (4,700)

Total ¥(11,611) ¥09,655 ¥(2,432 $0(98,842)

The differences between the provision for income taxes and

the income taxes computed using Japan statutory tax rate to

pretax income as a percentage of pretax income are as follows:

Years ended March 31 2006 2005 2004

Statutory tax rate (% ) 40.70% 40.70% 42.05%

Tax rate difference from foreign

consolidated affiliates —(1.23) (2.29)

Effect of tax rate change —(0.86) (0.22)

Dividend received deduction (602.92) ——

Valuation allowance 175.04 ——

Investment tax credit (29.14) (0.58) (2.19)

Impairment charge for goodwill and

intangible assets 42.20 ——

Reversal of valuation allowance on

deferred tax assets —— (3.50)

Others 3.14 1.72 (1.88)

Income tax expense (% ) (370.98)% 39.75% 31.97%

The components of the deferred tax assets and liabilities as

of March 31, 2006 and 2005 consist of the following:

Thousands of

Millions of yen U.S. dollars

2006 2005 2006

Deferred tax assets:

Software development costs ¥00,641 ¥00,951 $005,457

Accrued paid absence 281 134 2,453

Accrued pension costs 1,548 500 13,223

Enterprise tax payable 38 810 323

Prepaid expenses —310 —

Accrued bonus 709 416 6,035

Reserve for sales return and price

protection 358 442 3,048

Accrued expense and other 180 366 1,536

Investment securities 339 934 2,888

Investment tax credit —80 —

Net operating loss 16,867 —143,589

(Less valuation allowance) (7,206) —(61,247)

Other 2,384 747 20,096

Gross deferred tax assets ¥16,139 ¥05,690 $137,401

Deferred tax liabilities:

Software development costs —¥00,968 —

Fixed assets ¥14,650 13,752 $124,716

Valuation gain on investment

securities 365 324 3,106

Other 59 127 504

Gross deferred tax liabilities ¥15,074 ¥15,171 $128,326

Net deferred tax assets (liabilities) ¥01,065 ¥ (9,481) $009,075

On April 1st, 2003, the acquisition of Square took place in

the form of a qualified non-taxable merger. Accordingly, the

tax attributes to produce future tax deduction in the amount

of ¥9,867 million were transferred, without limitation, to the

Company. It included pre-merger net operating loss carryfor-

wards (NOLs) and the deductible temporary difference that

arose from a past write-off of a depreciable motion picture film

in the amount of ¥1,661 million and ¥2,211 million, respec-

tively. Transferred pre-merger NOLs were fully utilized in the

year ended March 31, 2004.

Following the acquisition of 93.7% of outstanding shares of

Taito (“ Old Taito” ) in September 2005, the Company engaged

in the minority cash-out transaction by means of a forward tri-

angular merger so as for Old Taito to become a wholly owned

subsidiary of the Company. “ SQEX” , another wholly owned

subsidiary of the Company, was used for a vehicle of merger.

Upon consummation of the merger, surviving SQEX was

renamed “ Taito Corporation (“ New Taito” )” . The merger was

taxable for Japanese tax purposes. Accordingly, tax basis of

assets of Old Taito transferred to New Taito were stepped up to

their respective fair values, and New Taito recognized goodwill

in its balance sheet in the amount of ¥26,686 million, which

was tax deductible over 5 years on a straight-line basis. New

Taito deducted from income an amortization of goodwill,

currently in the taxable year of 2006, which resulted in NOL of

¥4,873 million for tax purposes subject to carry-forward of 7

years over next taxable year. Also, in the course of merger, the

Company, as one of the Old Taito’s shareholders, received from

Old Taito the merger consideration in total amount of ¥63,292

million.Whereas the receipt of consideration was eliminated in

consolidation for financial reporting purposes and had no effect

to the consolidated financial statement of income for the year

of 2006, a portion thereof was deemed comprised of the

receipt of constructive dividend and the incurrence of capital

loss in the same amount of ¥46,364 million for tax purposes.

Because constructive dividend is subject to dividend received

deduction (“ DRD” ) for tax purposes, DRD offset the income of

the Company to the extent of its income before DRD, currently

in the taxable year of 2006. The unused portion of DRD resulted

in NOL of ¥36,586 million, which was carried forward to next

7 years.

At March 31, 2006, the U.S. subsidiary has NOLs and research

and development credits (R&D credits) for federal income tax

purposes of approximately $27.75 million and $0.74 million,

expiring beginning in 2022 and 2019, respectively. Utilization

of NOLs and R&D credits has certain limitations.

At March 31, 2006, the Chinese subsidiaries have NOLs

and tax credits for Chinese tax purposes of approximately

13,150 million RMB and 0.223 million RMB, expiring beginning

in 2010, respectively. Utilization of NOLs and tax credits has

certain limitations.