Square Enix 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3 4 3 5

A n n u a l R e p o r t 2 0 0 6

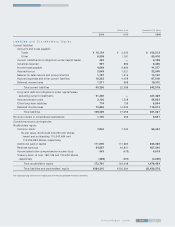

3. Lease payments, reversal of impairment of leased assets,

depreciation, interest and impairment loss:

Lease payments ¥552 million

Depreciation expense ¥552 million

4. Method of calculation for depreciation

Same as FY2004

(Impairment loss)

No impairment loss is recognized for leased assets.

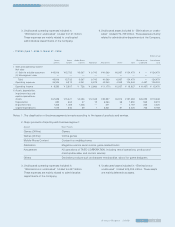

S e c u r it ie s

• FY2004 (April 1, 2004 to March 31, 2005)

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

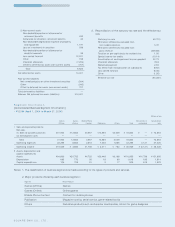

3. Other investment securities with market value:

Millions of yen

Acquisition Book Unrealized

Type cost value gain (loss)

Securities with book (1) Stocks ¥179 ¥0,994 ¥814

value exceeding

acquisition cost Subtotal 179 994 814

Securities with (1) Stocks ¥076 ¥0,058 ¥ (18)

acquisition cost

exceeding book value Subtotal 76 58 (18)

Total ¥256 ¥1,052 ¥796

Note: Impairment loss on securities is charged to income when

the market price at the end of the fiscal year falls less

than 50% of the acquisition cost. Impairment loss on

securities is charged to income when the market price at

the end of the fiscal year falls between 30% and 50% of

the acquisition cost after considering factors such as the

significance of amount and the possibility of recovery.

4. Securities sold during the fiscal year:

(April 1, 2004 to March 31, 2005)

Millions of yen

Amount of sale Gain on sale Loss on sale

¥248 ¥106 ¥2

5. Investment securities whose fair values are not readily deter-

mined as of March 31, 2005:

Millions of yen

Book value

(1) Other marketable securities

Unlisted securities (excluding OTC securities) ¥81

Unlisted overseas bonds —

6. Redemption schedule of other securities with a maturity

date on those to be held to maturity

Not applicable

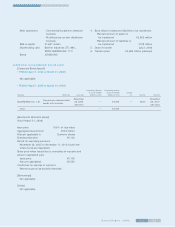

• FY2005 (April 1, 2005 to March 31, 2006)

1. Held-for-sale securities

Not applicable

2. Held-to-maturity securities with market value

Not applicable

3. Other investment securities with market value:

Millions of yen

Acquisition Book Unrealized

Type cost value gain (loss)

Securities with book (1) Stocks ¥174 ¥1,128 ¥953

value exceeding

acquisition cost Subtotal 174 1,128 953

Securities with (1) Stocks ¥210 ¥0,197 ¥ (12)

acquisition cost

exceeding book value Subtotal 210 197 (12)

Total ¥384 ¥1,325 ¥941

Note: In the period ended March 31, 2006, the impairment loss

associated with the fair market value determination of

other investment securities with market value was ¥91

million. Impairment loss on securities is charged to income

when the market price at the end of the fiscal year falls

less than 50% of the acquisition cost. Impairment loss on

securities is charged to income when the market price at

the end of the fiscal year falls between 30% and 50% of

the acquisition cost after considering factors such as the

significance of amount and the possibility of recovery.

In the period ended March 31, 2005, the impairment

loss associated with the fair market value determination

of other investment securities with market value was

¥80 million.

4. Securities sold during the fiscal year:

(April 1, 2005 to March 31, 2006)

Millions of yen

Amount of sale Gain on sale Loss on sale

¥1,504 ¥1,353 ¥—

5. Investment securities whose fair values are not readily deter-

mined as of March 31, 2005 and 2006:

Millions of yen

Book value

(1) Other marketable securities

Unlisted securities (excluding OTC securities) ¥132

Unlisted overseas bonds 0