Square Enix 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

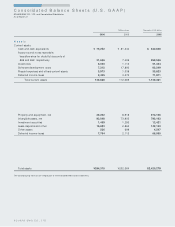

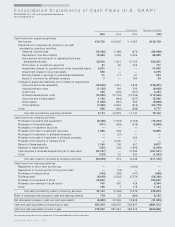

S Q U A R E E N IX C O . , L T D .

C o n s o lid a t e d S t a t e m e n t s o f C a s h F lo w s (U . S . G A A P )

SQUARE ENIX CO., LTD. and Consolidated Subsidiaries

Years ended March 31

Millions of yen Thousands of U.S. dollars

2006 2005 2004 2006

Cash flows from operating activities:

Net income ¥14,702 ¥14,520 ¥04,355 $125,159

Adjustments to reconcile net income to net cash

provided by operating activities:

Deferred income taxes (10,395) (1,486) (673) (88,489)

Depreciation and amortization 10,093 4,455 5,406 85,920

Amortization and write-off of capitalized software

developments costs 23,916 7,321 12,723 203,591

Write-down of investment securities 91 80 375 777

Impairment charge for goodwill and other intangible assets 5,521 —— 47,002

Impairment losses on long-lived assets 500 —— 4,275

Minority interest in earnings of consolidated subsidiaries 31 117 61 264

Equity in income of an affiliated company 7— 760 63

Changes in assets and liabilities, net of effects of acquisitions:

Accounts and notes receivable (15,039) 4,351 4,849 (128,021)

Accrued pension costs (1,135) 193 200 (9,658)

Inventories 402 (235) (437) 3,424

Software development costs (13,340) (12,704) (12,226) (113,550)

Accounts and notes payable 1,798 (948) (507) 15,306

Other assets (1,052) (281) 555 (8,959)

Other liabilities (7,492) 9,954 (916) (63,779)

Other 566 (462) (388) 4,777

Net cash provided by operating activities 9,174 24,875 14,137 78,102

Cash flows from investing activities:

Purchases of property and equipment (8,258) (1,319) (2,709) (70,303)

Purchases of intangible assets (341) (363) (416) (2,899)

Purchases of investment securities ——— —

Proceeds from sale of investment securities 1,505 248 — 12,809

Purchases of investment in affiliated company —(27) — —

Proceeds from sale of investment in affiliated company —— 423 —

Proceeds from maturity of treasury bond —2,000 — —

Refund of lease deposits 1,160 105 407 9,877

Payment of lease deposits (235) (102) (1,843) (2,000)

Cash acquired in business acquisitions (net of cash used) (53,747) — 12,095 (457,541)

Other (123) 32 292 (1,045)

Net cash (used in) provided by investing activities (60,039) 574 8,249 (511,102)

Cash flows from financing activities:

Repayment of short-term borrowings —— (1,000) —

Repayment of current portion of long term debt —(18) — —

Purchases of treasury stock (104) (155) (147) (889)

Dividends paid (6,618) (3,302) (2,574) (56,336)

Proceeds from issuance of bond 50,000 ——425,640

Proceeds from exercise of stock option 740 560 428 6,304

Other 136 7 719 1,154

Net cash provided by (used in) financing activities 44,154 (2,908) (2,574) 375,873

Effect of exchange rate changes on cash and cash equivalents 719 28 (984) 6,122

Net (decrease) increase in cash and cash equivalents (5,992) 22,569 18,828 (51,005)

Cash and cash equivalents at beginning of year ¥81,244 ¥58,675 ¥39,847 $691,613

Cash and cash equivalents at end of year ¥75,252 ¥81,244 ¥58,675 $640,608

The accompanying notes are an integral part of these consolidated financial statements.