Square Enix 2006 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

In North America, the Company’s main businesses are Games

(Offline), Games (Online) and Mobile Phone Content. In the Games

(Offline) business in this region, game titles developed by the

Company are sold under license mainly by SQUARE ENIX, INC. In

the fiscal year under review, several titles for the PS2 were released,

including “ Dragon Quest VIII: Journey of the Cursed King” and

“ Kingdom Hearts II.” The Company’s online game service

PlayOnline—focused on “ FINAL FANTASY XI” —performed well,

recording membership growth on par with that achieved in Japan.

As a result, sales in North America increased ¥3,340 million, to

¥15,635 million.

Europe

Years ended March 31 Millions of yen

2005 2006 Change

¥1,298 ¥1,378 ¥80

The Company primarily conducts Games (Offline), Games (Online)

and Mobile Phone Content businesses in Europe. In the PAL region,

sales of the Company’s game content are generally licensed to

leading European publishers. However, during the period under

review, SQUARE ENIX LTD., a wholly owned subsidiary of the

Company in this region, began preparations for game sales under

the Company’s own brand. The Company also launched online

game and mobile phone content services in the European market in

the previous fiscal year. As a result, sales in Europe increased ¥80

million, to ¥1,378 million.

Asia

Years ended March 31 Millions of yen

2005 2006 Change

¥1,179 ¥3,025 ¥1,846

In Asia, the Company provides primarily Games (Online) and

Amusement services. In the Games (Online) business, the Company

primarily operates the CROSS GATE online game service for the PC

platform in China. In the Amusement business, the Company oper-

ates game center facilities in Korea and China. Sales in Asia

increased ¥1,846 million compared with the previous fiscal year, to

¥3,025 million.

4 . S t r a t e g ic O u t lo o k , Is s u e s F a c in g

M a n a g e m e n t a n d F u t u r e D ir e c t io n

It is management’s main task to grow the Company in the medium

and long term, maintaining profitability with the creation of

advanced, high-quality content.

As the development and popularization of information technology

(IT) and network environments are rapidly advancing, new digital

entertainment will transform the industry structure in the near

future; customer needs for network-compliant entertainment will

increase; and multi-functional terminals will enable users easy

access to various types of content.

It is the Company’s medium- and long-term strategy to respond

to such changes and open a new era of digital entertainment.

In the fiscal year ending March 31, 2007, as part of our imple-

mentation of a medium-term business strategy, we will focus on

expanding our existing offline game franchises and strengthening

our network-related businesses. We will also work to restore

profitability to the Amusement business.

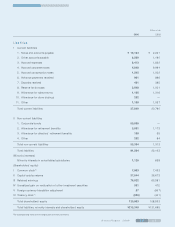

The Group’s targets for the fiscal year ending March 31, 2007,

are as follows:

Years ended March 31 Millions of yen

2004 2005 2006 2007

Results Results Results Targets

Net sales ¥63,202 ¥73,864 ¥124,473 ¥150,000

Operating income 19,398 26,438 15,470 19,000

Ordinary income 18,248 25,901 15,547 19,000

Net income 10,993 14,932 17,076 11,000

Owing to the consolidation of Taito at the end of September

2005, Taito’s operating results are reflected in the Company’s con-

solidated statements of income from October 2005. Following this

merger, we have set an operating income ratio of 20% or more

and average annual growth in net income per share (EPS) of 10%

as our main numerical targets.

5 . D iv id e n d P o lic y

It is one of the Company’s most important management policies to

return profit to shareholders. We will reserve retained earnings as

we take priority over investments for effective purposes for future

growth of corporate value, such as the enhancement and expan-

sion of existing business operations, capital investments for new

business development and merger and acquisition (M&A) activities.

Regarding returning profit to be expended for dividends, and we

will maintain continuous and stable dividend payouts.

6 . R is k F a c t o r s

C h a n g e s in t h e E c o n o m ic E n v ir o n m e n t

In the event of an exceptionally harsh downturn in the economy,

causing consumer expenditure to fall, demand for the Group’s

products and services in the entertainment field may decline. Such

circumstances may lead to an adverse impact on the Group’s

business performance.

C h a n g e s in C o n s u m e r P r e f e r e n c e s in t h e

D ig it a l C o n t e n t M a r k e t a n d t h e G r o u p ’s

A b ilit y t o R e s p o n d t o R a p id P r o g r e s s o f

In n o v a t iv e T e c h n o lo g y

In such a period of transition as stated in the medium- and long-

term strategy and tasks, it is probable such change may affect the

Group’s business performance if it is unable to deal with the

transitions properly and promptly.

C h a n g e s in G a m e P la t f o r m s a n d t h e

C o m p a n y’s R e s p o n s e

The Group’s core business predominantly involves the sale of soft-

ware for use on home-use video game consoles. Consequently, the

Company’s business may be subject to the impact of transition to

next-generation console platforms and changes in console manu-

facturers’ strategies. During platform generation transition periods,

there is a tendency for consumers to reduce their game software

purchases, which may lead to stagnation in the Company’s sales

growth. Such circumstances may lead to an adverse impact on the

Group’s business performance.