Square Enix 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

Content production account:

Same as FY2004

Amusement equipment:

Stated at cost, determined by the identified cost method

Unfinished goods:

Stated at cost, determined by the monthly average method

Certain consolidated subsidiaries, however, determine

cost by the moving-average method

Supplies:

Same as FY2004

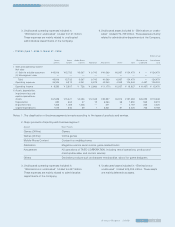

(2) Method for depreciation and amortization of major assets:

• FY2004 (April 1, 2004 to March 31, 2005)

A) Property and equipment

Property and equipment of the Company and its domestic

consolidated subsidiaries are depreciated using the declin-

ing-balance method. However, the straight-line method is

applied to buildings (excluding building fixtures) acquired

after April 1, 1998. The estimated useful lives of major

assets are as follows:

Buildings and structures 3–50 years

Tools and fixtures 3–15 years

B) Intangible assets

In-house software used by the Company and its domestic

consolidated subsidiaries is amortized using the straight-line

method based on an estimated useful life of five years. For

all other intangible fixed assets, trademarks are amortized

using the straight-line method based on an estimated useful

life of 10 years. Goodwill is amortized using the straight-line

method over a period of five years.

• FY2005 (April 1, 2005 to March 31, 2006)

A) Property and equipment

Property and equipment of the Company and its domestic

consolidated subsidiaries are depreciated using the declin-

ing-balance method. However, the straight-line method is

applied to buildings (excluding building fixtures) acquired

after April 1, 1998. The estimated useful lives of major

assets are as follows:

Buildings and structures 3–65 years

Tools and fixtures 3–15 years

Amusement equipment 3–8 years

B) Intangible assets

Same as FY2004

(3) Accounting for allowances and reserves:

• FY2004 (April 1, 2004 to March 31, 2005)

A) Allowance for doubtful accounts

An allowance for doubtful accounts provides for possible

losses arising from default on accounts receivable. The

allowance is made up of two components: the estimated

credit loss for doubtful receivables based on an individual

assessment of each account, and a general reserve calculated

based on historical default rates.

B) Reserve for bonuses

A reserve for bonuses provided for payments to employees

of the Company and its consolidated subsidiaries at the

amount expected to be paid in respect of the calculation

period ended on the balance sheet date.

C) Allowance for sales returns

An allowance is provided for losses due to the return of

published materials, at an amount calculated based on

historic experience, prior to this fiscal year. In addition, an

allowance is provided for losses due to the return of game

software, at an estimated amount of future losses assessed

by each game title.

D) Allowance for store closings

—————

E) Allowance for retirement benefits

An allowance for retirement benefits is provided at the

amount incurred during this fiscal year, which is based on

the estimated present value of the projected benefit obliga-

tion. Unrecognized actuarial differences are fully amortized

in the next year in which they arise. Unrecognized prior ser-

vice cost is amortized over a certain period (one year) within

the average remaining service period of the employees. In

addition, the Company and its domestic consolidated sub-

sidiaries provide a reserve for retirement benefits equal to

100% of such benefits the Company and its subsidiaries

would be required to pay under the lump-sum retirement

plan if all eligible employees were to voluntarily terminate

their employment at the balance sheet date.

F) Allowance for directors’ retirement benefits

An allowance for directors’ retirement benefits is provided

to adequately cover the costs of directors’ retirement

benefits, which are accounted for on an accrual basis in

accordance with internal policy.

• FY2005 (April 1, 2005 to March 31, 2006)

A) Allowance for doubtful accounts

Same as FY2004

B) Reserve for bonuses

Same as FY2004

C) Allowance for sales returns

An allowance is provided for losses due to the return of

published materials, at an amount calculated based on

historic experience, prior to this fiscal year. In addition, an