Square Enix 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 8 1 9

A n n u a l R e p o r t 2 0 0 6

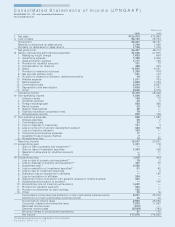

Non-Operating Income and Expenses

Years ended March 31 Millions of yen

2005 2006 Change

Non-operating income ¥0,542 ¥1,046 ¥(503

Non-operating expenses 1,080 968 (111)

In the fiscal year under review, non-operating income amounted

to ¥1,046 million, an increase of ¥503 million compared with the

previous fiscal year. Within this figure, the Company recorded a

foreign exchange gain totaling ¥508 million, compared with ¥296

million for this item in the previous fiscal year. Other items included

increases in interest income and dividends received.

Non-operating expenses amounted to ¥968 million, a decrease

of ¥111 million compared with the previous fiscal year. This

included a loss on write-off of the content production account

totaling ¥460 million, compared with ¥983 million for this item in

the previous fiscal year.

Extraordinary Gain and Loss

Years ended March 31 Millions of yen

2005 2006 Change

Extraordinary gain ¥118 ¥1,361 ¥1,243

Extraordinary loss 443 7,878 7,435

Extraordinary gain amounted to ¥1,361 million, an increase of

¥1,243 million compared with the previous fiscal year. This was

primarily due to a gain on sale of investment securities relating to

the sale of shares in Mag Garden Corporation.

Extraordinary loss amounted to ¥7,878 million, an increase of

¥7,435 million compared with the previous fiscal year. This included

impairment loss of ¥4,426 million, extraordinary disposal loss on

inventories of ¥1,652 million, adjustment loss in connection with

advance received in mobile phone business of ¥302 million, loss

on liquidation of affiliate of ¥209 million, provision for doubtful

accounts of ¥505 million and provision to allowance for store

closings of ¥153 million.

Impairment loss was mainly related to UIEVOLUTION goodwill.

For details, please refer to the note on page 33 of this report.

Extraordinary disposal loss on inventories, provision for doubtful

accounts and provision to allowance for store closings stemmed

from the inclusion of Taito in the Company’s scope of consolida-

tion. These items were related to the write-offs of inventory such

as coin-operated amusement machines, and reserve provisions for

closure of unprofitable game center facilities.

Adjustment loss in connection with advance received in mobile

phone business resulted from the increase in significance of a user

point program run as part of the Mobile Phone Content business.

This loss was posted in relation to unused points awarded up to the

previous fiscal year.

Loss on liquidation of affiliate related to the establishment of a

wholly owned subsidiary in China, SQUARE ENIX (China) CO., LTD.,

and the accompanying transfer of operations from a formerly exist-

ing 60% -owned affiliate, SQUARE ENIX WEBSTAR NETWORK

TECHNOLOGY (BEIJING) CO., LTD. (SEW). The business transfer led

to a loss on liquidation of SEW.

Dividends

For the previous fiscal year, the Company paid an ordinary dividend

of ¥30 per share and a commemorative dividend of ¥30 per share,

for a total annual dividend of ¥60 per share. For the fiscal year

under review, the Company paid a ¥30 per share ordinary dividend

only. This was mainly owing to an income increase relating to tax

effects, which are expected to materialize in the future but have

not produced a cash increase at this stage.

Capital Expenditures and Depreciation

Years ended March 31 Millions of yen

Reference:

2005 2006 Change Taito

Capital expenditures ¥1,814 ¥8,419 ¥6,605 ¥6,364

Depreciation 1,523 9,169 7,646 6,521

Note: Depreciation does not include amortization of goodwill.

Capital expenditures for the fiscal year ended March 31, 2006,

amounted to ¥8,419 million, an increase of ¥6,605 million com-

pared with the previous fiscal year. This was mainly owing to the

consolidation of Taito.

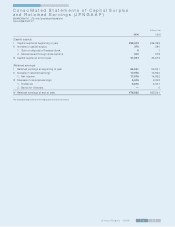

Amortization of Goodwill

In March 2004, the Company acquired UIEVOLUTION and made it

a wholly owned subsidiary of SQUARE ENIX, INC., a wholly owned

subsidiary of the Company. The purpose of this acquisition was to

acquire information and telecommunication technologies funda-

mental to the development of network-related businesses, and

bolster the Company’s product and service capabilities in this area.

As a result of this transaction, the Company posted goodwill

amounting to U.S.$507 million. In the previous fiscal period, the

Company commenced amortization of this goodwill over five years.

However, in the fiscal year under review the Company compared

projected future cash flows from this subsidiary with its book value,

and decided to post an impairment loss of ¥3,926 million, which is

the amount projected at this stage as unrecoverable.

In addition, accompanying the consolidation of Taito during the

period under review, the Company recorded goodwill amounting

to ¥23,283 million. This amount will be amortized over 20 years

commencing from the fiscal year under review.

As a result of the factors outlined above, amortization of

goodwill totaled ¥1,827 million.

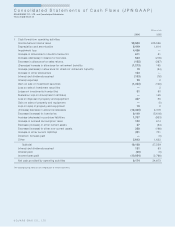

O v e r s e a s S a le s

Geographic segment sales are dependent on game title develop-

ment in Japan. As a result, overseas sales fluctuate depending on

the timing of overseas game title releases.

North America

Years ended March 31 Millions of yen

2005 2006 Change

¥12,295 ¥15,635 ¥3,340