Square Enix 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5 8 5 9

A n n u a l R e p o r t 2 0 0 6

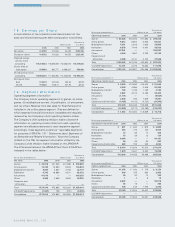

The future benefit payments for the plan are expected

as follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2007 ¥0,500 $04,257

2008 503 4,280

2009 577 4,913

2010 516 4,392

2011 518 4,409

2012–2016 2,873 24,458

Retirement Benefit to Directors and Statutory Auditors

In order to prepare for the payment of retirement benefit to the

Company’s directors and statutory auditors in the future, the

Company internally funds a retirement allowance. The Board

of Directors determined the certain formula for calculation of

retirement benefits, pursuant to which, the benefits are calcu-

lated based on a certain fixed amount multiplied by the number

of years of office and the coefficient predetermined by the

Board according to the title of directors. New legislature, the

Japanese Corporation Law (“ JCL” ), was introduced effective

May 1st, 2006 as an amendment of former Japanese Commer-

cial Code (“ JCC” ). The JCL requires the Company to have its

shareholders’ approval for payment, and the Company accrues

retirement allowance according to such formula until the

benefits are approved by the shareholders. The balances of

¥189 million and ¥55 million at March 31, 2006 and March 31,

2005, respectively, are presented as “ other long-term liabilities”

in the consolidated balance sheets. Charges to income for the

directors’ and corporate auditors’ retirement plans were ¥19

million, ¥121 million and ¥6 million in 2006, 2005 and 2004,

respectively.

1 5 . L o n g -T e r m D e b t

Long-term debt as of March 31, 2006 is as follows:

Thousands of

Millions of yen U.S. dollars

2006 2006

Unsecured Zero Coupon Convertible Debenture,

due in November 2010 ¥50,000 $425,651

Total Long-term debt ¥50,000 $425,651

Yen denominated unsecured zero coupon convertible

debenture was privately issued offshore on November 25, 2005

to Daiwa Securities SMBC Europe Limited, a UK corporation.

The debenture indenture has a provision that the conversion

price per share shall be adjusted once in a year on the 3rd Friday

in every November (“ the date of price adjustment” ) in 2006

and thereafter to the price 6% below the average of volume-

weighted average prices of underlying stock of the Company at

the Tokyo Stock Exchange (“ TSE” ) for ten consecutive trading

days on or before the date of price adjustment. Notwithstanding

the foregoing, the conversion price shall not be adjusted below

the floor price, which is equal to the closing price of underlying

stock of the Company at the TSE as of November 8, 2005, the

date one-day before the date when the Company decided the

issue. The Company has an option, (“ Option” ), to move the

floor price per share to the market price of underlying stock at

the time of the exercise of Option or ¥1,700, whichever is then

greater. The Option is exercisable only once throughout the life

of debenture. The initial conversion price per share applicable

on or before the date of first price adjustment and the floor

price per share are ¥5,100 and ¥3,400, respectively. As of the

date of issuance of this report, the Company has not exercised

the Option.

If underlying stock is traded at the price of 115% of conver-

sion price then applicable for 10 consecutive trading days on

the TSE, the Company is able to redeem the debenture in full

at par, with the irrevocable 30 days advanced notice to the debt

holder commencing from the end of such 10 consecutive trading

days, at any time during the period on or after November 25,

2005 until November 24, 2010. The Company is also given the

right to redeem the debenture in full at 1.015 of its face value,

with the irrevocable 30 days advanced notice to the debt holder

prior to the redemption, on or after November 28, 2005 before

the exercise of the Option. Once the Option is exercised, the

Company is able to redeem the debenture in full at par, with

the irrevocable 30 days advanced notice to the debt holder

prior to the redemption, after the date 6 months after the date

of exercise of the Option until November 24, 2010.

Line of Credit

As of March 31, 2006, the Company had an unused line of

credit with a bank in the amount of ¥71,000 million at various

rates expiring in 2007. No guarantee is provided for such

line-of-credit.

1 6 . In c o m e T a x e s

Domestic and foreign income before income taxes are as follows:

Thousands of

Years ended March 31 Millions of yen U.S. dollars

2006 2005 2004 2006

Domestic ¥0,195 ¥21,745 ¥4,577 $01,665

Foreign 2,934 2,547 3,031 24,979

Total ¥3,129 ¥24,292 ¥7,608 $26,644