Square Enix 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

S e g m e n t In f o r m a t io n

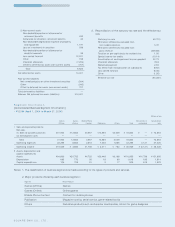

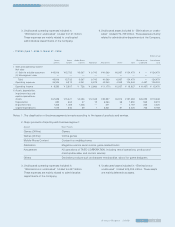

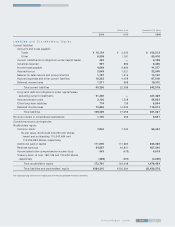

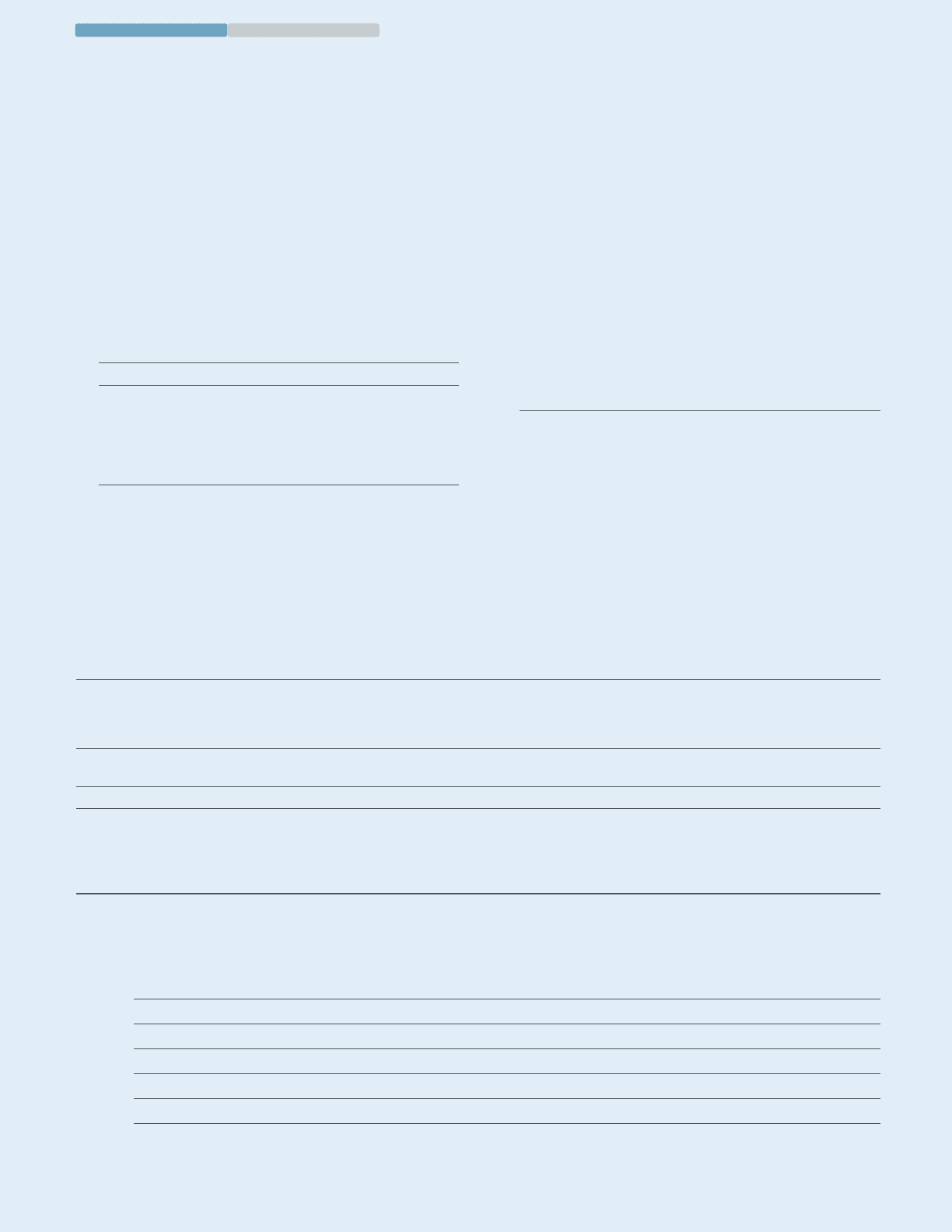

[Consolidated Business Segment Information]

• FY2004 (April 1, 2004 to March 31, 2005)

Millions of yen

Games Games M obile Phone Eliminations or Consolidated

(Offline) (Online) Content Publication Others Total unallocated total

I Sales and operating income

Net sales

(1) Sales to outside customers ¥41,944 ¥13,853 ¥4,557 ¥10,859 ¥2,649 ¥073,864 ¥ — ¥073,864

(2) Intersegment sales ————————

Total 41,944 13,853 4,557 10,859 2,649 73,864 — 73,864

Operating expenses 22,295 8,866 2,818 7,448 1,866 43,295 4,131 47,426

Operating income ¥19,649 ¥04,986 ¥1,738 ¥03,411 ¥0,782 ¥030,569 ¥ (4,131) ¥026,438

II Assets, depreciation and

capital expenditures

Assets ¥64,860 ¥20,752 ¥4,725 ¥20,448 ¥6,168 ¥116,955 ¥14,739 ¥131,695

Depreciation 693 770 35 19 99 1,618 195 1,814

Capital expenditures 106 725 51 3 17 905 618 1,523

Notes: 1. The classification of business segments is made according to the types of products and services.

2. Major products offered by each business segment:

Segment M ajor Products

Games (Offline) Games

Games (Online) Online games

Mobile Phone Content Content for mobile phones

Publication Magazine comics, serial comics, game-related books

Others Derivative products such as character merchandise, school for game designers

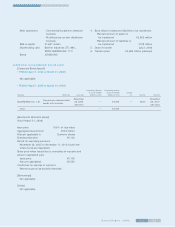

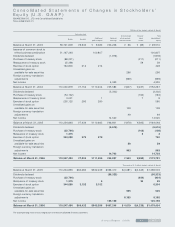

2) Non-current assets

Non-deductible portion of allowance for

retirement benefits 433

Allowance for directors’ retirement benefits 34

Non-deductible depreciation expense of property

and equipment 1,191

Loss on investments in securities 339

Non-deductible portion of allowance for

doubtful accounts 38

Loss carried forward 12,201

Other 198

Valuation allowance (7,206)

Offset to deferred tax assets (non-current assets) (707)

Total 6,523

Net deferred tax assets 14,401

Non-current liabilities

Net unrealized gains on other investment securities (364)

Other (342)

Offset to deferred tax assets (non-current assets) 707

Total deferred tax liabilities —

Balance: Net deferred tax assets (liabilities) ¥14,401

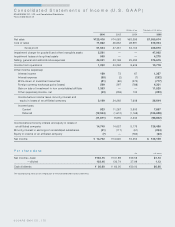

2. Reconciliation of the statutory tax rate and the effective tax

rate

Statutory tax rate 40.70%

Permanent differences excluded from

non-taxable expenses 0.72

Permanent differences excluded from

gross revenue (209.88)

Taxation on per capita basis for residents tax 1.05

Special income tax credits (10.14)

Amortization of and impairment loss on goodwill 22.73

Valuation allowance 78.8

Reclaimed payment 2.94

Tax effect from reorganization of subsidiaries (9.50)

Loss carried forward (6.35)

Other (1.35)

Effective tax rate (90.28)%