Square Enix 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3 6 3 7

A n n u a l R e p o r t 2 0 0 6

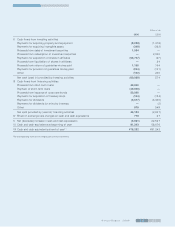

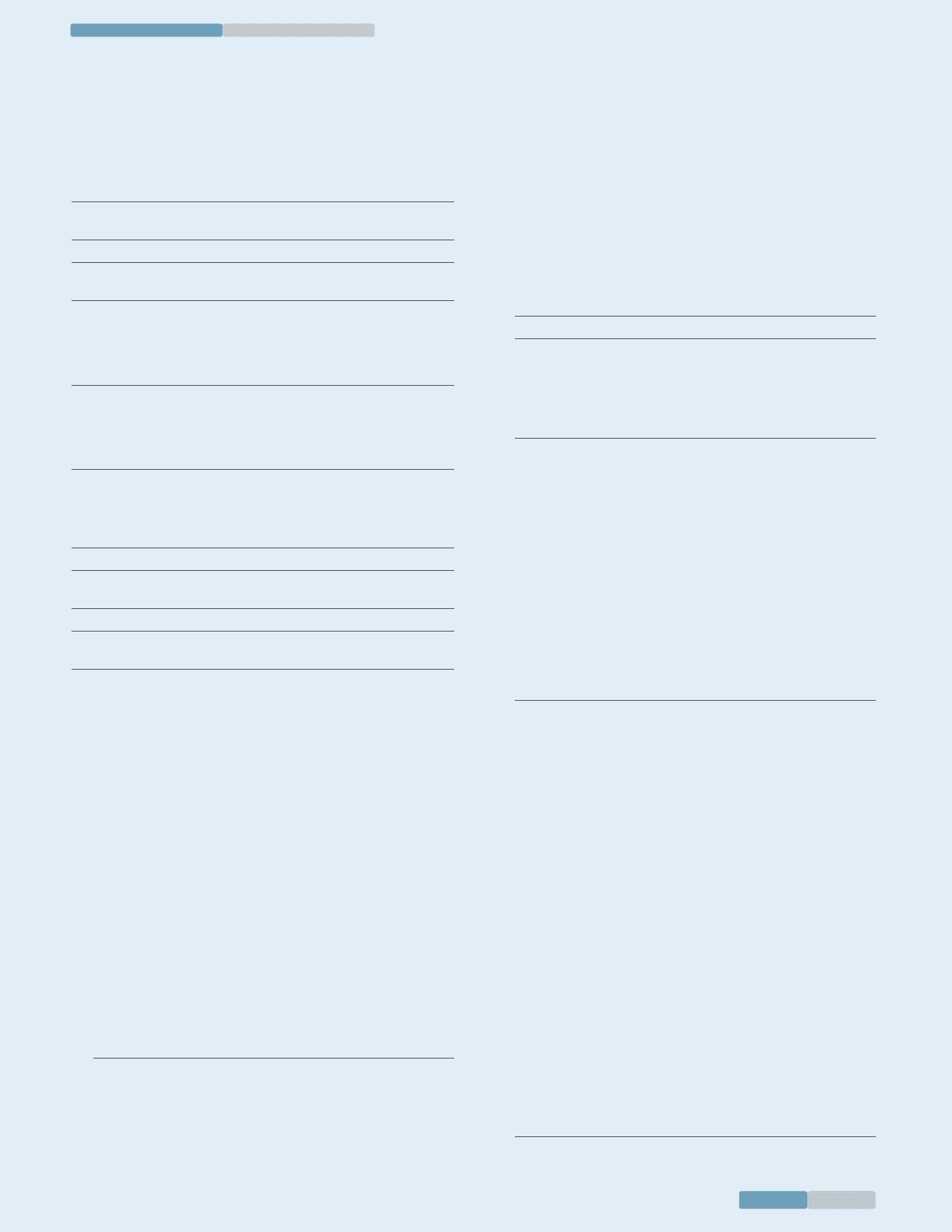

2. Retirement benefit obligation:

Millions of yen

Retirement benefit obligation ¥11,249

Fair value of plan assets 10,622

Net unfunded obligation 627

Unrecognized prior service cost 1,895

Unrecognized actuarial loss 479

Allowance for retirement benefits ¥03,001

3. Retirement benefit expenses:

Millions of yen

Service cost ¥(378

Interest cost 129

Expected return on plan assets (89)

Amortization of prior service cost (356)

Amortization of net actuarial gains and losses (103)

Retirement benefit expenses ¥0(40)

4. Assumption used in accounting for retirement benefit

obligation:

Periodic allocation method for projected benefits Straight-line basis

Discount rate 1.700% –1.837%

Expected rate of return on plan assets 1.700%

Years over which prior service costs are amortized 1–5 years

Years over which net actuarial gains and losses

are amortized 1–5 years

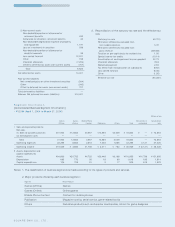

T a x Ef f e c t A c c o u n t in g

• FY2004 (April 1, 2004 to March 31, 2005)

1. Significant components of deferred tax assets and liabilities

are summarized as follows:

Millions of yen

Deferred tax assets

1) Current assets

Enterprise tax payable ¥0,809

Office tax payable 19

Accrues bonuses, allowance for bonuses

to employees 415

Advances paid 310

Accrued expenses 346

Allowance for sales return 442

Non-deductible portion of allowance for

doubtful accounts 162

Tax credits 80

Non-deductible portion of allowance for content

production account (190)

Evaluation loss on content 1,140

Other (97)

Total 3,440

2) Non-current assets

Non-deductible portion of allowance for

retirement benefits 477

Allowance for directors’ retirement benefits 31

Non-deductible depreciation expense of property

and equipment 562

Tax effect on deficit of subsidiaries 690

Loss on investments in securities 242

Other 87

Offset to deferred tax assets (non-current assets) (324)

Total 1,768

Net deferred tax assets 5,209

Deferred tax liabilities

Non-current liabilities

Net unrealized gains on other investment securities (324)

Offset to deferred tax assets (non-current assets) 324

Total deferred tax liabilities —

Balance: Net deferred tax assets (liabilities) ¥5,209

2. Reconciliation of the statutory tax rate and the effective tax

rate:

Statutory tax rate 40.70%

Permanent differences excluded from

non-taxable expenses 0.17

Permanent differences excluded from

gross revenue (0.01)

Taxation on per capita basis for residents tax 0.04

Special income tax credits (0.56)

Amortization on consolidation adjustment account 2.43

Difference in tax rate with the parent company (1.17)

Other (0.49)

Effective tax rate 41.11%

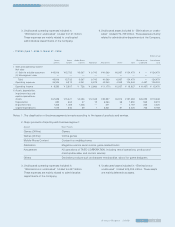

• FY2005 (April 1, 2005 to March 31, 2006)

1. Significant components of deferred tax assets and liabilities

are summarized as follows:

Millions of yen

Deferred tax assets

1) Current assets

Enterprise tax payable ¥o,o37

Office tax payable 20

Accrued bonuses, allowance for bonuses

to employees 708

Advances paid 128

Accrued expenses 180

Allowance for sales return 358

Non-deductible portion of allowance for

doubtful accounts 169

Non-deductible portion of allowance for content

production account (194)

Evaluation loss on content 835

Loss carried forward 4,665

Non-deductible valuation gain on allowance

for retirement benefits 1,060

Non-deductible amortization of goodwill 191

Other (285)

Total 7,877