Square Enix 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S Q U A R E E N IX C O . , L T D .

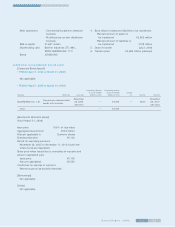

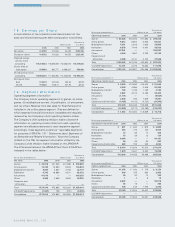

Advertising Expenditures

The Company recognizes advertising expense as it is incurred

except for cooperative advertising. Cooperative advertising

obligations are accrued and amortized at the same time the

related revenues are recognized. Total advertising expense was

approximately ¥7,458 million, ¥5,346 million and ¥5,119 million

for the year ended March 31, 2006, 2005 and 2004, respectively.

Recently Issued Accounting Pronouncements

In November 2004, the Financial Accounting Standards Bord

(“ FASB” ) issued SFAS No. 151, Inventory Costs, an amendment

of ARB No. 43. This statement clarifies the accounting for idle

capacity expense, freight, handling costs, and wasted material

and is effective for inventory costs incurred during fiscal years

beginning after June 15, 2005. The Company believes the

adoption of this statement will not have a material effect on

its results of operations, cash flows or financial position.

In December 2004, the FASB issued SFAS No. 123(R), Share

Based Payment. This statement establishes standards for the

accounting for transactions in which an entity exchanges its

equity instruments for goods and services. It focuses primarily on

accounting for transactions in which an entity obtains employee

services in share-based payment transactions (employee stock

options). The statement requires the measurement of the cost

of employee services received in exchange for an award of

equity instruments (such as employee stock options) at fair

value on the grant date. That cost will be recognized over the

period during which an employee is required to provide services

in exchange for the award (the requisite service period). This

statement is effective as of the beginning of the first annual

reporting period that begins after December 15, 2005. The

Company is adopting transition methods under this standard.

In December 2004, the FASB issued SFAS No. 153, Exchanges

of Non-monetary Assets, an amendment of APB 29. This state-

ment clarifies that all non-monetary transactions that have

commercial substance should be recorded at fair value and is

effective for the fiscal periods beginning after June 15, 2005.

The Company believes the adoption of this statement will not

have a material effect on its results of operations, cash flows or

financial position.

In June 2005, the EITF Issue No. 05-6, Determining the

Amortization Period for Leasehold Improvements Purchased

after Lease Inception or Acquired in a Business Combination.

Issue No. 05-6 states that leasehold improvements that are

placed in service significantly after the beginning of the lease

term should be amortized over the shorter of the useful life of

the assets or a term that includes required lease periods and

renewals that are deemed to be reasonably assured at the date

the leasehold improvements are purchased. The pronounce-

ment is effective for leasehold improvements that are purchased

or acquired in reporting periods beginning after June 29, 2005.

The Company believes the adoption of this issue has had no

material impact on its consolidated financial statements.

In June 2005, the FASB issued FSP No. FAS 150-5. This FSP

clarifies that freestanding warrants and other similar instru-

ments on shares that are redeemable (either puttable or

mandatorily redeemable) should be accounted for as liabilities

under FASB Statement No. 150, Accounting for Certain Finan-

cial Instruments w ith Characteristics of Both Liabilities and

Equity, regardless of the timing of the redemption feature or

price, even though the underlying shares may be classified as

equity. This FSP is effective for the first reporting period begin-

ning after June 30, 2005. The Company believes the adoption

of this issue has had no material impact on its consolidated

financial statements.

Stock-Based Compensation

The Company accounts for its incentive stock option plans using

intrinsic value method in accordance with Accounting Principles

Board Opinion No. 25, “ Accounting for Stock Issued to Employ-

ees” (“ APB25” ). Under APB25, generally no compensation

expenses are recorded when the terms of the award are fixed

and the exercise price of the stock option equals or exceeds

the fair value of the underlying stock on the date of grant.

In fiscal 2003, the Company adopted the disclosure provisions

of SFAS No. 148 “ Accounting for Stock-Based Compensation-

Transaction and Disclosure—an Amendment of FASB Statement

No. 123” , which provides alternative methods of transition for

a voluntary change to the fair value based method of accounting

for stock-based employee compensation.

On April 1, 2003, the Company took over SQUARE’s stock

option plan as a result of the merger, pursuant to which, the

directors, officers and employees of former SQUARE may pur-

chase up to an aggregate of 3,330,895 shares of common

stock of the Company. This plan expires in the year of 2009.

In June 2004, the stockholders of the Company approved

the Company’s Stock Option Plan, pursuant to which, officers,

directors, employees of the Company may purchase up to an

aggregate of 600,000 shares of common stock. This plan

expires in the year of 2009.