SkyWest Airlines 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2010

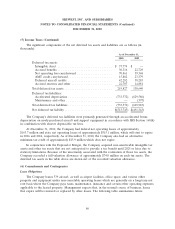

(7) Fair Value Measurements

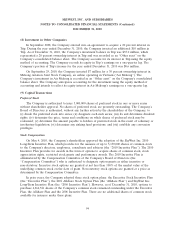

The Company holds certain assets that are required to be measured at fair value in accordance

with United States GAAP. The Company determined fair value of these assets based on the following

three levels of inputs:

Level 1 — Quoted prices in active markets for identical assets or liabilities.

Level 2 — Observable inputs other than Level 1 prices such as quoted prices for similar assets or

liabilities; quoted prices in markets that are not active; or other inputs that are

observable or can be corroborated by observable market data for substantially the full

term of the assets or liabilities. Some of the Company’s marketable securities

primarily utilize broker quotes in a non-active market for valuation of these securities.

Level 3 — Unobservable inputs that are supported by little or no market activity and that are

significant to the fair value of the assets or liabilities, therefore requiring an entity to

develop its own assumptions.

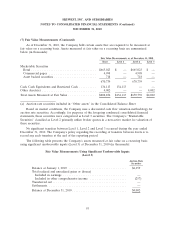

As of December 31, 2010, the Company held certain assets that are required to be measured at

fair value on a recurring basis. The Company has invested in auction rate security instruments, which

are classified as available for sale securities and reflected at fair value. However, due primarily to credit

market events beginning during the first quarter of 2008, the auction events for most of these

instruments failed. Therefore, quoted prices in active markets are no longer available and the Company

has estimated the fair values of these securities utilizing a discounted cash flow analysis as of

December 31, 2010. These analyses consider, among other items, the collateralization underlying the

security investments, the creditworthiness of the counterparty, the timing of expected future cash flows,

and the expectation of the next time the security is expected to have a successful auction.

As of December 31, 2010, the Company owned $4.0 million of auction rate security instruments.

The auction rate security instruments held by the Company at December 31, 2010 were tax-exempt

municipal bond investments, for which the market has experienced some successful auctions. The

Company has classified the investments as non-current and has identified them as ‘‘Other assets’’ in its

Consolidated Balance Sheet as of December 31, 2010. The Company has classified these securities as

non-current due to the Company’s belief that the market for these securities may take in excess of

twelve months to fully recover. As of December 31, 2010, the Company continued to record interest on

all of its auction rate security instruments. Any future fluctuations in fair value related to these

instruments that the Company deems to be temporary, including any recoveries of previous write

downs, would be recorded to accumulated other comprehensive income. If the Company determines

that any future valuation adjustment was other than temporary, a charge would be recorded to earnings

as appropriate.

92