SkyWest Airlines 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.goals. Under the Atlantic Southeast Delta Connection Agreement, excess margins over certain

percentages must be returned to or shared with Delta, depending on various conditions. Atlantic

Southeast’s United code-share operations are conducted under a United Express Agreement pursuant

to which Atlantic Southeast is paid primarily on a fee-per-completed block hour and departure basis,

plus a margin based on performance incentives (the ‘‘Atlantic Southeast United Express Agreement’’).

Under the Atlantic Southeast United Express Agreement, excess margins over certain percentages must

be returned or shared with United, depending on various conditions.

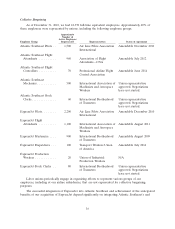

ExpressJet

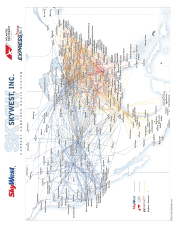

ExpressJet provides regional jet service principally in the United States, primarily from hubs

located in Cleveland, Newark, Houston, Chicago (O’Hare) and Washington Dulles. ExpressJet offered

more than 1,300 daily scheduled departures as of December 31, 2010, of which approximately 1,050

were Continental Express flights and 250 were United Express flights. ExpressJet’s fleet as of

December 31, 2010 consisted of 244 ERJ145s 206 of which were flown for Continental, 35 of which

were flown for United and three of which were used for charter operations. ExpressJet’s Continental

and United code-share operations are conducted under a Capacity Purchase Agreement executed

between ExpressJet and Continental (‘‘Continental CPA’’) and a United Express Agreement executed

between ExpressJet and United (‘‘ExpressJet United Express Agreement’’) pursuant to which

ExpressJet is paid by Continental or United, as applicable, primarily on a fee-per-completed block hour

and departure basis, plus a margin based on performance incentives.

Competition and Economic Conditions

The airline industry is highly competitive. SkyWest Airlines, Atlantic Southeast and ExpressJet

compete principally with other code-sharing regional airlines, but also with regional airlines operating

without code-share agreements, as well as low-cost carriers and major airlines. The combined

operations of SkyWest Airlines, Atlantic Southeast and ExpressJet extend throughout most major

geographic markets in the United States. Our competition includes, therefore, nearly every other

domestic regional airline, and to a certain extent, most major and low-cost domestic carriers. The

primary competitors of SkyWest Airlines, Atlantic Southeast and ExpressJet among regional airlines

with code-share arrangements include Air Wisconsin Airlines Corporation, American Eagle

Airlines, Inc. (‘‘American Eagle’’) (owned by American Airlines, Inc. (‘‘American’’)), Comair, Inc.

(‘‘Comair’’) (owned by Delta), Compass Airlines (‘‘Compass’’), Mesaba Airlines (‘‘Mesaba’’), Horizon

Air Industries, Inc. (‘‘Horizon’’) (owned by Alaska Air Group, Inc. (‘‘Alaska Airlines’’)), Mesa Air

Group, Inc. (‘‘Mesa’’), Pinnacle Airlines Corp. (‘‘Pinnacle’’), Republic Airways Holdings Inc.

(‘‘Republic’’) and Trans State Airlines, Inc.(‘‘Trans State’’) Major airlines award contract flying to these

regional airlines based upon, but not limited to, the following criteria: low cost, financial resources,

overall customer service levels relating to on-time arrival and departure statistics, cancellation of flights,

baggage handling performance and the overall image of the regional airline as a whole. The principal

competitive factors we experience with respect to our pro-rate flying include fare pricing, customer

service, routes served, flight schedules, aircraft types and relationships with major partners.

The principal competitive factors for code-share partner regional airlines are code-share agreement

terms, customer service, aircraft types, fare pricing, flight schedules and markets and routes served. The

combined operations of SkyWest Airlines, Atlantic Southeast and ExpressJet represent the largest

regional airline operation in the United States. However, some of the major and low-cost carriers are

larger, and have greater financial and other resources than SkyWest Airlines, Atlantic Southeast and

ExpressJet, individually or collectively. Additionally, regional carriers owned by major airlines, such as

American Eagle and Comair, may have access to greater resources, through their parent companies,

than SkyWest Airlines, Atlantic Southeast and ExpressJet, and may have enhanced competitive

advantages since they are subsidiaries of major airlines. Moreover, federal deregulation of the industry

6