SkyWest Airlines 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Committee’s policy for several years, but is subject to review and continuation or modification each

year by the Committee. The Chief Executive’s targeted level of long-term incentive awards is higher

than the targeted level of long-term incentive awards for other Executives since he has overall

responsibility for the long-term success of the Company. Each Executive’s 2010 long-term incentive

award was allocated among three types of long-term grants, each with equal value, as follows: stock

options, restricted stock units, and performance units payable in cash.

The three types of awards were used in an effort to link the Executives’ long-term incentive

compensation with the creation of shareholder value. The value of stock options and restricted stock

units is directly related to the value of the Common Stock. The Executives earn performance units

payable in cash by meeting return on shareholder equity objectives that the Committee believes also

lead to long-term shareholder value, but are not subject to short-term stock market volatility.

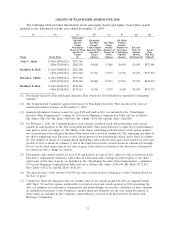

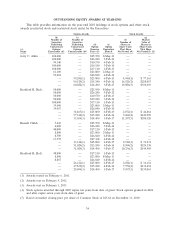

Stock options, restricted stock unit and performance unit grants in 2010 were made pursuant to

the 2006 Long-Term Incentive Plan, as shown in greater detail below in the table labeled ‘‘Grants of

Plan Based Awards.’’

Stock Options—Options (which include options which are subject to performance-based vesting

conditions) are granted with an exercise price equal to the closing price per share on the date of grant

and vest three years after the date of grant. Grants are made on a systematic schedule, generally one

grant per year made at the first Committee meeting of each year.

The purpose of the one-third weighting on stock options (including options subject to

performance-based vesting conditions) is to tie a significant percentage of the award’s ultimate value to

increases in the stock price, thereby rewarding increased value to the shareholders. A stock option only

has a value to the extent the value of the underlying shares on the exercise date exceeds the exercise

price. Accordingly, stock options provide compensation only if the underlying share price increases over

the option term and the Executive’s employment continues through the vesting date.

The size of the grant for each Executive is calculated by determining the number of shares with a

theoretical future value equal to the targeted compensation for stock options, assuming each option will

have a value equal to 33% of its exercise price. This value generally correlates to the ASC Topic 718

value of the awards.

Restricted Stock Units—The Company also granted restricted stock units to the Executives in 2010.

The restricted stock units awarded to an Executive entitle the Executive to receive a designated number

of shares of Company common stock upon completion of a three-year vesting period, measured from

the date of grant. Until the vesting date the shares underlying restricted stock units are not considered

issued and outstanding. Accordingly, the Executive is not entitled to vote or receive dividends on the

shares underlying his restricted stock units unless and until those restricted stock units vest. The

purpose of the one-third restricted stock unit component is to support continued employment through

volatile economic and stock market conditions, to manage dilution overhang, and to align officers’

interests with maintaining shareholder value already created. The Committee believes this approach

mitigates the incentive for Executives to take unnecessary risks and helps retain the Executives’

expertise through continued employment. Recipients of restricted stock units do not pay for the

underlying shares once the awards vest; however they must remain employed by the Company for three

years to receive the underlying shares. Restricted stock unit awards provide the Executives with an

indirect ownership stake in the Company and encourage the Executive to continue employment in

order to receive the underlying shares. The compensation value of a restricted stock unit award does

not depend solely on future stock price increases. Although its value may increase or decrease with

changes in the stock price during the period before vesting, a restricted stock unit award will likely

have value even without future stock price appreciation. Accordingly, restricted stock unit awards

deliver significantly greater share-for-share compensation value at grant than do stock options, and the

26