SkyWest Airlines 2010 Annual Report Download - page 58

Download and view the complete annual report

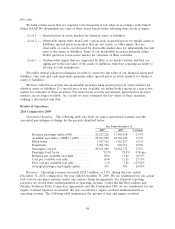

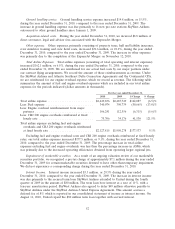

Please find page 58 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Passenger revenues. Passenger revenues decreased $884.0 million, or 25.5%, during the year ended

December 31, 2009, compared to the year ended December 31, 2008. The decrease in passenger

revenues was primarily due to a decrease in fuel reimbursements from our major partners. The fuel

reimbursement from our major partners decreased $824.9 million or 69.6%, during the year ended

December 31, 2009, compared to the year ended December 31, 2008. Our passenger revenues,

excluding fuel and engine overhaul reimbursements from major partners, decreased $51.6 million, or

2.4%, during the year ended December 31, 2009, compared to the year ended December 31, 2008. The

percentage decrease in passenger revenues, excluding fuel and engine overhaul reimbursements, was

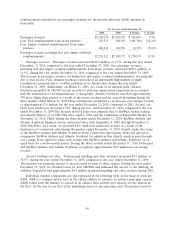

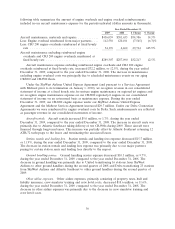

more than the percentage increase in ASMs, primarily due to three factors. First, Atlantic Southeast

experienced an abnormally high number of flight cancellations in part due to significant weather related

cancellations in its Atlanta hub during the three months ended March 31, 2009. Additionally, on

March 31, 2009, as a result of an internal audit, Atlantic Southeast grounded 60 CRJ200s in order to

perform engine safety inspections in accordance with the manufacturer’s recommendations. Atlantic

Southeast cancelled approximately 750 scheduled flights as a result of the severe weather and aircraft

grounding during the first quarter of 2009. As a result, Atlantic Southeast experienced a negative

impact on passenger revenues of approximately $7.6 million. Second, Delta transitioned ground

handling services at 23 stations from SkyWest Airlines and Atlantic Southeast to other ground handlers

during the second quarter of 2009. Revenue earned under ground handling contracts where we provide

ground handling services for our own aircraft is presented in the ‘‘Passenger revenue’’ line in our

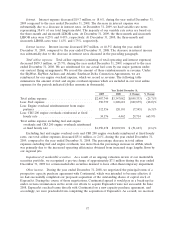

consolidated statements of income. Third, on October 23, 2009, Delta sent letters to SkyWest Airlines

and Atlantic Southeast requiring them to either adjust the rates payable under their respective Delta

Connection Agreements or accept termination of those agreements Delta’s letter also notified SkyWest

Airlines and Atlantic Southeast of Delta’s estimate of the average rates to be applied under those

agreements. On October 28, 2009, SkyWest Airlines and Atlantic Southeast notified Delta of their

election to adjust the rates payable under the Delta Connection Agreements; however, they also

notified Delta of their disagreement with Delta’s estimated rates and their belief that the methodology

Delta used to calculate its estimated rates is inconsistent with the terms of the Delta Connection

Agreements. Because SkyWest Airlines and Atlantic Southeast had not reached an agreement with

Delta regarding the final contractual rates to be established under the Delta Connection Agreements as

of December 31, 2009, we evaluated the method for calculating the average rate of the carriers within

the Delta Connection Program under the revenue recognition accounting guidance and recorded

revenue under those agreements based on management’s understanding of the applicable terms in the

Delta Connection Agreements and management’s best estimate of the revenue that would ultimately be

realized upon settlement of the contractual rates with Delta with respect to the year ended

December 31, 2009. SkyWest Airlines and Atlantic Southeast reached an agreement with Delta related

to the average rate provisions in November 2010.

Ground handling and other. Total ground handling and other revenues increased $1.4 million, or

4.7%, during the year ended December 31, 2009, compared to the year ended December 31, 2008.

Revenue earned under other ground handling contracts where we provide ground handling services for

other airlines is presented in the ‘‘Ground handling and other’’ line in our consolidated statements of

income. The increase was primarily related to the higher volume of flights serviced under ground

handling contracts with United and Delta during 2009, whereby we performed ground handling services

for several other regional airlines.

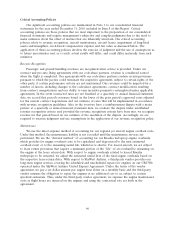

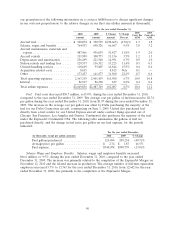

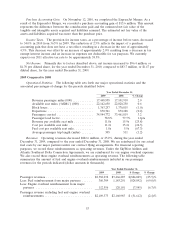

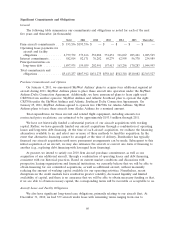

Individual expense components for the periods indicated are expressed in the following table on

the basis of cents per ASM. ASM is a common metric used in the airline industry to measure an

airline’s passenger capacity. ASMs reflect both the number of aircraft in an airline’s fleet and the seat

capacity for the aircraft in the fleet. As the size of our fleet is the underlying driver of our operating

costs, the primary basis for our presentation in this Item 7 is on a cost per ASM basis to discuss

54