SkyWest Airlines 2010 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

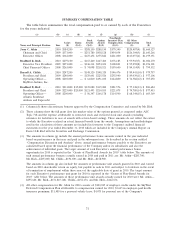

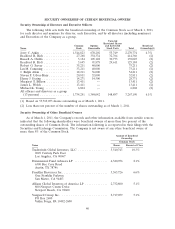

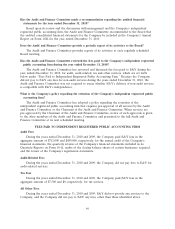

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Security Ownership of Directors and Executive Officers

The following table sets forth the beneficial ownership of the Common Stock as of March 1, 2011,

for each director and nominee for director, each Executive, and by all directors (including nominees)

and Executives of the Company as a group.

Unvested

Restricted Shares

Common Options and Restricted Beneficial

Name Stock Exercisable Stock Units Total Ownership(1)

Jerry C. Atkin ................. 1,544,823 670,202 55,749 2,270,774 4.3%

Bradford R. Rich ............... 27,268 354,334 32,764 414,366 (2)

Russell A. Childs ............... 3,124 105,128 30,773 139,025 (2)

Bradford R. Holt ............... 3,695 91,878 29,611 125,184 (2)

Robert G. Sarver ............... 35,211 40,000 75,211 (2)

Ian M. Cumming ............... 33,211 40,000 73,211 (2)

J. Ralph Atkin ................. 18,211 36,000 54,211 (2)

Steven F. Udvar-Hazy ............ 20,811 32,000 52,811 (2)

Henry J. Eyring ................ 14,271 14,500 28,771 (2)

Margaret S. Billson ............. 13,411 — 13,411 (2)

James L. Welch ................ 13,411 — 13,411 (2)

Michael K. Young .............. 6,804 — 6,804 (2)

All officers and directors as a group

(13 persons) ................. 1,734,251 1,384,042 148,897 3,267,190 6.1%

(1) Based on 53,769,053 shares outstanding as of March 1, 2011.

(2) Less than one percent of the number of shares outstanding as of March 1, 2011.

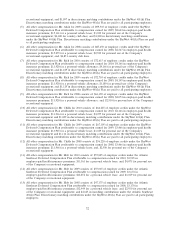

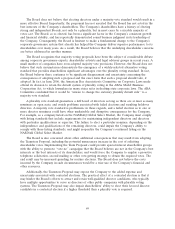

Security Ownership of Other Beneficial Owners

As of March 1, 2011, the Company’s records and other information available from outside sources

indicated that the following shareholders were beneficial owners of more than five percent of the

outstanding shares of Common Stock. The information following is as reported in their filings with the

Securities and Exchange Commission. The Company is not aware of any other beneficial owner of

more than 5% of the Common Stock.

Amount of Beneficial

Ownership

Common Stock

Name Shares Percent of Class

Tradewinds Global Investors, LLC ................. 5,540,743 10.3%

2049 Century Park East

Los Angeles, CA 90067

Dimensional Fund Advisors LP ................... 4,340,956 8.1%

6300 Bee Cave Road

Austin, TX 78746

Franklin Resources Inc. ......................... 3,565,726 6.6%

One Franklin Parkway

San Mateo, CA 94403

Allianz Global Investors of America LP ............. 2,732,800 5.1%

800 Newport Center Drive

Newport Beach, CA 92600

Vanguard Group Inc. .......................... 2,717,059 5.1%

PO Box 2600

Valley Forge, PA 19482-2600

40