SkyWest Airlines 2010 Annual Report Download - page 49

Download and view the complete annual report

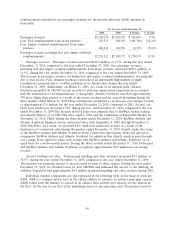

Please find page 49 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.converted into the right to receive $6.75 per share in cash, payable to the holder thereof, without

interest. Based on the number of outstanding shares of ExpressJet Holdings common stock as of the

effective time of the Merger, the aggregate value of the ExpressJet Merger consideration was

$131.6 million. After taking into effect the number of shares acquired by SkyWest and its subsidiaries,

the aggregate value of the ExpressJet Merger consideration was $136.5 million. As part of the

ExpressJet Merger, we recorded a purchase accounting gain of $15.6 million. This amount represents

the difference between the consideration paid and the net fair value of ExpressJet Holdings’ tangible

and intangible assets acquired and liabilities assumed. The fair value of the assets and liabilities

acquired were more than purchase price.

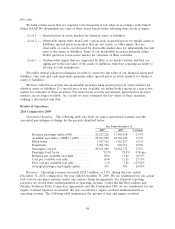

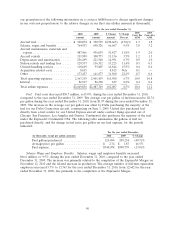

Under the SkyWest Airlines and Atlantic Southeast United Express Agreements, we recognize

revenue in our consolidated statement of income at a fixed hourly rate for mature engine maintenance

on regional jet engines and we recognize engine maintenance expense on our CRJ200 regional jet

engines in our consolidated statement of income on an as-incurred basis as maintenance expense.

During the year ended December 31, 2010, our CRJ200 engine expense under our SkyWest Airlines

and Atlantic Southeast United Express Agreements and our AirTran code-share agreement increased

$41.5 million compared to the year ended December 31, 2009. The increase in CRJ 200 engine

overhauls reimbursed at a fixed hourly rate was principally due to scheduled engine maintenance

events. We anticipate the average quarterly number of scheduled engine maintenance events we

experienced during the year ended December 31, 2010 will likely continue each quarter through 2011

and the first quarter of 2012.

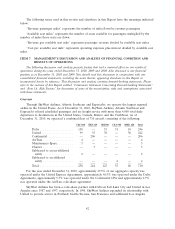

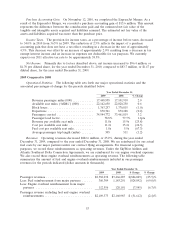

Total available seat miles (‘‘ASMs’’) for the year ended December 31, 2010 increased 15.2%,

compared to the year ended December 31, 2009, primarily due to the ExpressJet Merger, as well as

SkyWest Airlines’ acceptance of 18 new CRJ700s since April 1, 2009, and its incremental placement of

those aircraft into service over that period. During the year ended December 31, 2010, we generated

25.5 billion ASMs, compared to 22.1 billion ASMs during the year ended December 31, 2009.

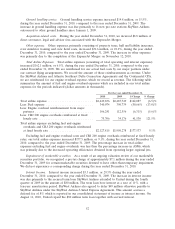

On October 16, 2009, SkyWest Airlines extended to United a secured term loan in the amount of

$80 million. The term loan bore interest at a rate of 11%, with a ten-year amortization period. The

loan was secured by certain ground equipment and airport slot rights held by United. On August 11,

2010, United repaid the $80 million term loan.

On September 29, 2010, we invested $7 million for a 30% ownership interest in Mekong Aviation

Joint Stock Company, an airline operating in Vietnam (‘‘Air Mekong’’). We anticipate accounting for

the investment using the equity method of accounting and intend to reflect our equity interest in Air

Mekong’s earnings on a one-quarter lag.

Outlook

On January 4, 2011, we announced SkyWest Airlines’ plans to acquire four additional regional jet

aircraft during 2011. SkyWest Airlines plans to place these aircraft into operation under the SkyWest

Airlines Delta Connection Agreement. Additionally, we have announced plans to lease eight used

CRJ700s from another operator. SkyWest Airlines and Atlantic Southeast plan to operate the eight

CRJ700s under the SkyWest Airlines and Atlantic Southeast Delta Connection Agreements. On

January 25, 2011, SkyWest Airlines agreed to operate five CRJ700s for Alaska Airlines. SkyWest

Airlines plans to lease these aircraft from Alaska Airlines for a nominal amount.

45