SkyWest Airlines 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Aircraft Leases

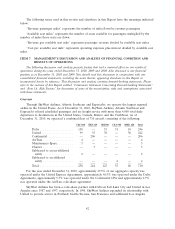

The majority of SkyWest Airlines’ aircraft are leased from third parties, while Atlantic Southeast’s

aircraft are primarily debt-financed on a long-term basis and the majority of ExpressJet’s aircraft are

leased from Continental for a nominal amount. In order to determine the proper classification of our

leased aircraft as either operating leases or capital leases, we must make certain estimates at the

inception of the lease relating to the economic useful life and the fair value of an asset as well as select

an appropriate discount rate to be used in discounting future lease payments. These estimates are

utilized by management in making computations as required by existing accounting standards that

determine whether the lease is classified as an operating lease or a capital lease. All of our aircraft

leases have been classified as operating leases, which results in rental payments being charged to

expense over the terms of the related leases. Additionally, operating leases are not reflected in our

consolidated balance sheet and accordingly, neither a lease asset nor an obligation for future lease

payments is reflected in our consolidated balance sheets.

Impairment of Long-Lived and Intangible Assets

As of December 31, 2010, we had approximately $2.9 billion of property and equipment and

related assets. Additionally, as of December 31, 2010, we had approximately $21.7 million in intangible

assets. In accounting for these long-lived and intangible assets, we make estimates about the expected

useful lives of the assets, the expected residual values of certain of these assets, and the potential for

impairment based on the fair value of the assets and the cash flows they generate. We recorded an

intangible of approximately $33.7 million relating to the acquisition of Atlantic Southeast. The

intangible is being amortized over fifteen years under the straight-line method. As of December 31,

2010, we had recorded $12.0 million in accumulated amortization expense. Factors indicating potential

impairment include, but are not limited to, significant decreases in the market value of the long-lived

assets, a significant change in the condition of the long-lived assets and operating cash flow losses

associated with the use of the long-lived assets. On a periodic basis, we evaluate whether the book

value of our aircraft is impaired. Based on the results of the evaluations, our management concluded

no impairment was necessary as of December 31, 2010. However, there is inherent risk in estimating

the future cash flows used in the impairment test. If cash flows do not materialize as estimated, there is

a risk the impairment charges recognized to date may be inaccurate, or further impairment charges

may be necessary in the future.

Stock-Based Compensation Expense

We estimate the fair value of stock options as of the grant date using the Black-Scholes option

pricing model. We use historical data to estimate option exercises and employee termination in the

option pricing model. The expected term of options granted is derived from the output of the option

pricing model and represents the period of time that options granted are expected to be outstanding.

The expected volatilities are based on the historical volatility of our common stock and other factors.

47