SkyWest Airlines 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To our Shareholders

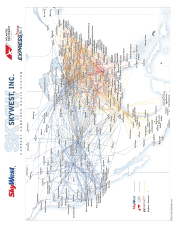

The year ended December 31, 2010, will likely go down in our corporate history as being one of

our most significant. While we faced continued challenges from an industry with little to no growth, we

successfully acquired another airline known for its quality and thereby created meaningful growth and

future opportunity for our company. On November 12, 2010, we acquired ExpressJet Holdings, Inc.,

(‘‘ExpressJet’’), whose primary entity is ExpressJet Airlines, for a total cash price of approximately

$136.5 million, after giving effect for the shares that we previously acquired during the year. Even with

the acquisition of ExpressJet, we ended the year with approximately $805 million in cash and cash

equivalents and acquired good tangible assets thus preserving our solid balance sheet. With this

acquisition we now operate 244 Embraer regional jet aircraft (‘‘ERJ145’’), and we signed a new 10-year

capacity purchase agreement with Continental Airlines, Inc. Immediately following the closing of the

acquisition, we began post-merger integration efforts intended to combine the operations of ExpressJet

with our currently-owned Atlantic Southeast Airlines, Inc. (‘‘Atlantic Southeast’’) and create a more

efficient and streamlined entity eventually operating under one airline operating certificate. I’m pleased

to report that our initial integration efforts have been successful and we are well on our way to

achieving our goal of having ExpressJet and Atlantic Southeast combined by the 4th quarter of 2011.

While Atlantic Southeast was engaged in the acquisition, SkyWest Airlines, our other wholly-owned

airline subsidiary, continued to provide excellent operational and financial performance and has

continued its long history of being a consistent contributor to our success.

I’m also pleased to report that, in spite of the economic challenges facing many businesses,

including many carriers in our industry, we generated net income of $96.4 million, or $1.70 per diluted

share for 2010. Our total operating revenues for the year were $2.8 billion. By reporting net income for

the year we continued our long history of reporting profits and additionally increased our cash and

liquidity position, ending the year with approximately $805.0 million in cash and cash equivalents.

In addition to the ExpressJet acquisition, we acquired another 16 regional jet aircraft during the

year. These aircraft consisted of four new CRJ700 regional jets that represented the four final

deliveries under a previous order for 22 aircraft. We also acquired 12 previously-owned regional jet

aircraft that were integrated into our Delta Connection and United Express operations as a result of

additional demand required by our major partners. We also transitioned some aircraft out of contract

flying and used those aircraft to expand our pro-rate flying and ended the year with 61 aircraft in

pro-rate operations, up from 46 at the end of 2009. While our strategic objective is to continue to add

additional flying under capacity purchase agreements, the pro-rate flying creates an opportunity for us

to experiment, on a limited basis, in markets where we don’t operate contract flying. Additionally, due

to the unique short-term lease arrangements we have on many of our aircraft, we have flexibility and

can downsize a portion of the fleet, if necessary, in reacting to market conditions.

During the year we also continued repurchasing outstanding company shares under a board-

approved stock repurchase program. During 2010, we acquired a total of approximately 2.1 million

shares at a total cost of $30.0 million. Since 2007, when we began active efforts to repurchase our

shares, we have repurchased a total of approximately 14.3 million shares at a total cost of

$277.1 million. We currently have another 5.7 million shares authorized under this program and will

continue to acquire our shares in the open market from time to time under approved programs.

With regards to our investment in Trip Linhas Aereas (‘‘TRIP’’), a regional airline located in

Campinas, Brazil, TRIP continued its growth by operating additional regional aircraft during 2010.

During the year ended December 31, 2010, we invested another $10.0 million in TRIP for a total

investment of $30.0 million, representing a 20% ownership position. TRIP intends to continue its

growth strategy during 2011 and plans on introducing the Embraer 190 regional jet to complement its

existing operations of flying Embraer 175 regional jets and ATR-42 and ATR-72 regional aircraft.

We added an additional investment to our portfolio during 2010 by investing $7.0 million in the

Mekong Aviation Joint Stock Company (‘‘Air Mekong’’), which represents a 30% ownership position.

Air Mekong began operations on October 9, 2010, and is a regional jet operator flying to various

destinations within Vietnam. SkyWest and Atlantic Southeast have provided significant assistance in the