SkyWest Airlines 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2010

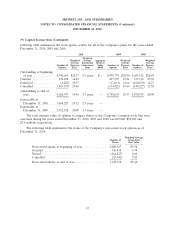

(6) Commitments and Contingencies (Continued)

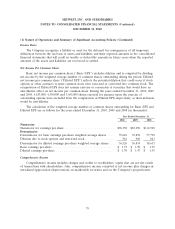

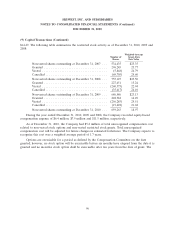

minimum rental payments required under operating leases that have initial or remaining non-cancelable

lease terms in excess of one year as of December 31, 2010 (in thousands):

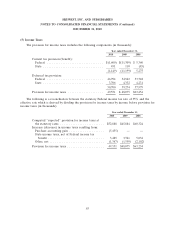

Year ending December 31,

2011 ................................................ $ 373,166

2012 ................................................ 352,082

2013 ................................................ 331,451

2014 ................................................ 316,067

2015 ................................................ 283,421

Thereafter ............................................. 1,083,545

$2,739,732

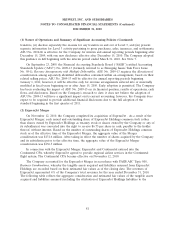

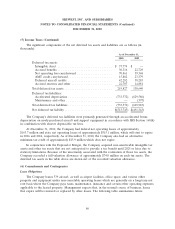

The majority of the Company’s leased aircraft are owned and leased through trusts whose sole

purpose is to purchase, finance and lease these aircraft to the Company; therefore, they meet the

criteria of a variable interest entity. However, since these are single owner trusts in which the Company

does not participate, the Company is not considered at risk for losses and is not considered the primary

beneficiary. As a result, based on the current rules, the Company is not required to consolidate any of

these trusts or any other entities in applying the accounting guidance. Management believes that the

Company’s maximum exposure under these leases is the remaining lease payments.

Total rental expense for non-cancelable aircraft operating leases was approximately $311.9 million,

$300.8 million and $295.8 million for the years ended December 31, 2010, 2009 and 2008, respectively.

The minimum rental expense for airport station rents was approximately $43.5 million, $47.7 million

and $59.4 million for the years ended December 31, 2010, 2009 and 2008, respectively.

The Company’s leveraged lease agreements, typically obligate the Company to indemnify the

equity/owner participant against liabilities that may arise due to changes in benefits from tax ownership

of the respective leased aircraft. The terms of these contracts range up to 17 years. The Company did

not accrue any liability relating to the indemnification to the equity/owner participant because of

management’s assessment that the probability of this occurring is remote.

Self-insurance

The Company self-insures a portion of its potential losses from claims related to workers’

compensation, environmental issues, property damage, medical insurance for employees and general

liability. Losses are accrued based on an estimate of the ultimate aggregate liability for claims incurred,

using standard industry practices and the Company’s actual experience. Actual results could differ from

these estimates.

87