SkyWest Airlines 2010 Annual Report Download - page 65

Download and view the complete annual report

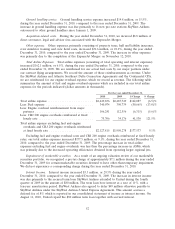

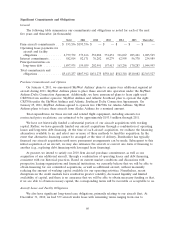

Please find page 65 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17 years. Future minimum lease payments due under all long-term operating leases were approximately

$2.7 billion at December 31, 2010. Assuming a 6.2% discount rate, which is the average rate used to

approximate the implicit rates within the applicable aircraft leases, the present value of these lease

obligations would have been equal to approximately $2.0 billion at December 31, 2010.

Long-term Debt Obligations

As of December 31, 2010, we had $1,898.0 million of long term debt obligations, primarily related

to the acquisition of Brasilia turboprop, CRJ200, CRJ700 and CRJ900 aircraft. The average effective

interest rate on the debt related to the Brasilia turboprop and CRJ aircraft was approximately 4.4% at

December 31, 2010.

Guarantees

We have guaranteed the obligations of SkyWest Airlines under the SkyWest Airlines Delta

Connection Agreement and the obligations of Atlantic Southeast under the Atlantic Southeast Delta

Connection Agreement and SkyWest and Atlantic Southeast have guaranteed the obligations of

ExpressJet under the Continental CPA.

New Accounting Standards

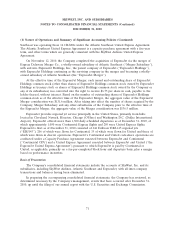

In January 2010, the FASB issued ASU No. 2010-06, Improving Disclosures about Fair Value

Measurements, an amendment to Accounting Standards Codification Topic 820, Fair Value Measurements

and Disclosures. This amendment requires an entity to: (i) disclose separately the amounts of significant

transfers in and out of Level 1 and Level 2 fair value measurements and describe the reasons for the

transfers, (ii) disclose separately the reasons for any transfers in and out of Level 3, and (iii) present

separate information for Level 3 activity pertaining to gross purchases, sales, issuances, and settlements.

ASU No. 2010-06 is effective for us for interim and annual reporting periods beginning after

December 15, 2009, with one new disclosure effective after December 15, 2010. We adopted this

guidance beginning with the interim period ended March 31, 2010. See Note 7 of the notes to our

consolidated financial statements set forth in Item 8 of this Report.

On September 23, 2009, the Financial Accounting Standards Board (‘‘FASB’’) ratified Accounting

Standards Update (‘‘ASU’’) No. 2009-13 (formerly referred to as Emerging Issues Task Force Issue

No. 08-1), Revenue Arrangements with Multiple Deliverables. ASU No. 2009-13 requires the allocation of

consideration among separately identified deliverables contained within an arrangement, based on their

related selling prices. ASU No. 2009-13 will be effective for annual reporting periods beginning

January 1, 2011; however, it will be effective only for revenue arrangements entered into or materially

modified in fiscal years beginning on or after June 15, 2010. Early adoption is permitted. The Company

has been evaluating the impact of ASU No. 2009-13 on its financial position, results of operations, cash

flows, and disclosures. Based on our research to date, we do not believe the adoption of ASU

No. 2009-13 will have a significant impact on our current accounting practices; however, we do expect

to be required to provide additional financial disclosures due to the full adoption of the standard

beginning in the first quarter of 2011.

61