SkyWest Airlines 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

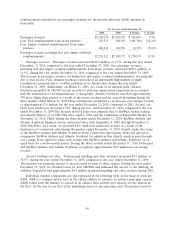

Interest. Interest expense decreased $19.7 million, or 18.6%, during the year ended December 31,

2009 compared to the year ended December 31, 2008. The decrease in interest expense was

substantially due to a decrease in interest rates. At December 31, 2009, we had variable rate notes

representing 38.6% of our total long-term debt. The majority of our variable rate notes are based on

the three-month and six-month LIBOR rates. At December 31, 2009, the three-month and six-month

LIBOR rates were 0.25% and 0.43%, respectively. At December 31, 2008, the three-month and

six-month LIBOR rates were 1.43% and 1.75%, respectively.

Interest income. Interest income decreased $9.7 million, or 46.5% during the year ended

December 31, 2009, compared to the year ended December 31, 2008. The decrease in interest income

was substantially due to the decrease in interest rates discussed in the preceding paragraph.

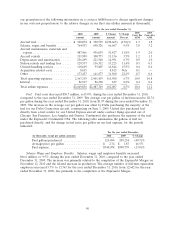

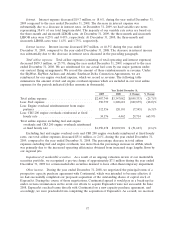

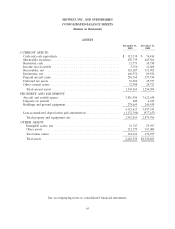

Total airline expenses. Total airline expenses (consisting of total operating and interest expenses)

decreased $859.3 million, or 25.7%, during the year ended December 31, 2009, compared to the year

ended December 31, 2008. We are reimbursed for our actual fuel costs by our major partners under

our contract flying arrangements. We record the amount of those reimbursements as revenue. Under

the SkyWest, SkyWest Airlines and Atlantic Southeast Delta Connection Agreements, we are

reimbursed for our engine overhaul expense, which we record as revenue. The following table

summarizes the amount of fuel and engine overhaul expenses which are included in our total airline

expenses for the periods indicated (dollar amounts in thousands).

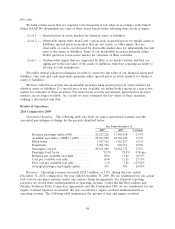

Year Ended December 31,

2009 2008 $ Change % Change

Total airline expense ......................... $2,487,749 $3,347,082 $(859,333) (25.7)%

Less: Fuel expense .......................... 390,739 1,220,618 (829,879) (68.0)%

Less: Engine overhaul reimbursement from major

partners ................................ 112,556 120,101 (7,545) (6.3)%

Less: CRJ 200 engine overhauls reimbursed at fixed

hourly rate .............................. 34,176 4,462 29,714 665.9%

Total airline expense excluding fuel and engine

overhauls and CRJ 200 engine overhauls reimbursed

at fixed hourly rate ........................ $1,950,278 $2,001,901 $ (51,623) (2.6)%

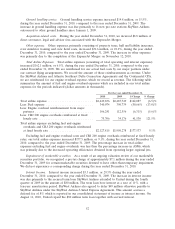

Excluding fuel and engine overhaul costs and CRJ 200 engine overhauls reimbursed at fixed hourly

rates, our total airline expenses decreased $51.6 million, or 2.6%, during the year ended December 31,

2009, compared to the year ended December 31, 2008. The percentage decrease in total airline

expenses excluding fuel and engine overhauls, was more than the percentage increase in ASMs, which

was primarily due to the increased operating efficiencies obtained from increased stage lengths flown by

our regional jets.

Impairment of marketable securities. As a result of an ongoing valuation review of our marketable

securities portfolio, we recognized a pre-tax charge of approximately $7.1 million during the year ended

December 31, 2009 for certain marketable securities deemed to have other-than-temporary impairment.

Other income. During the year ended December 31, 2008, we negotiated the principal terms of a

prospective capacity purchase agreement with Continental, which was intended to become effective if

we had successfully completed our proposed acquisition of the outstanding shares of capital stock of

ExpressJet. During the course of those negotiations, Continental agreed it would pay us a break-up fee

under certain circumstances in the event our efforts to acquire ExpressJet were not successful. In June

2008, ExpressJet reached terms directly with Continental on a new capacity purchase agreement, and

accordingly, we were precluded from completing the acquisition of ExpressJet. As a result, we received

57