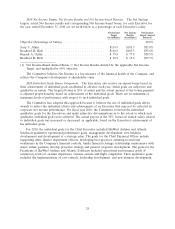

SkyWest Airlines 2010 Annual Report Download - page 149

Download and view the complete annual report

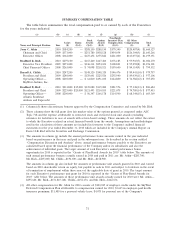

Please find page 149 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company can offer comparable grant date compensation value with fewer shares than if the grant were

made solely with stock options. This results in less dilution of the outstanding shares of Common Stock.

The annual award of restricted stock units to each Executive for 2010 consisted of the right to

receive upon future vesting that number of shares of Company stock having a value on the date of

grant equal to one-third of the Executive’s aggregate, targeted level of long-term incentive

compensation for 2010.

Performance Units—The remaining component of each Executive’s 2010 annual long-term incentive

award was a performance unit award payable in cash. The targeted cash amount of each Executive’s

performance unit award was set at one-third of the Executive’s aggregate, targeted level of long-term

incentive compensation for 2010. The purpose of the performance unit awards is to reward

achievement of a financial efficiency goal that supports shareholder value and reflects real performance

without regard to stock market volatility. Under each Executive’s performance unit award, a cash bonus

is payable three years from the date of grant, based on the level of ‘‘Shareholder Return on Equity’’ (as

defined below) earned in the year of grant, relative to the targeted level of Shareholder Return on

Equity, and also subject to the Executive’s continued employment through the date of payment. The

2010 Shareholder Return on Equity target was set as 8.36%, with the actual amount of cash bonus

payable to each Executive to be prorated based upon the extent to which the Company’s actual results

varied from the target level of performance.

The 2010 goal for each Executive (including the Presidents of the Company’s operating

subsidiaries) was based on the Shareholder Return on Equity for the entire Company. The Committee

elected not to establish individual goals for the Presidents of the Company’s operating subsidiaries

because the Committee sought to encourage teamwork and the creation of long-term value for the

Company’s shareholders. For purposes of the 2010 performance equity grants, ‘‘Shareholder Return on

Equity’’ was equal to shareholder return on equity, adjusted to exclude timing differences between

engine overhaul expenses and the related revenue collected from the Company’s major partners.

Earned performance unit awards are paid in cash to reduce share dilution and emphasize the real

economic cost of officer incentives. For each percentage point that the Shareholder Return on Equity is

above or below the established target, the performance unit award is increased or decreased

proportionately. The Company believes that the performance unit grant provides an effective long-term

incentive for the Executives to act in the best interests of shareholders, by focusing on return on

shareholder equity, which the Committee believes is one of the principal contributing factors to

long-term shareholder value.

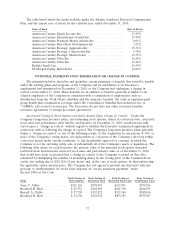

For 2010, the actual Shareholder Return on Equity was calculated as 8.58%, versus the 8.36%

targeted level of Shareholder Return on Equity. As a consequence, each Executive earned 102.6% of

the targeted level of cash award underlying his performance units, subject to risk of forfeiture if the

Executive terminates his employment (other than in connection with a change in control) prior to the

third anniversary of the date of grant.

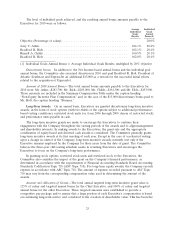

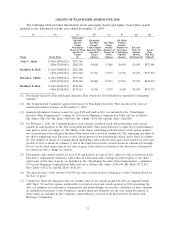

The Shareholder Return on Equity target, actual Shareholder Return on Equity, target dollar value

of performance units granted, and the resulting dollar value of performance units earned (subject to

27