SkyWest Airlines 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2010

(1) Nature of Operations and Summary of Significant Accounting Policies (Continued)

transfers, (ii) disclose separately the reasons for any transfers in and out of Level 3, and (iii) present

separate information for Level 3 activity pertaining to gross purchases, sales, issuances, and settlements.

ASU No. 2010-06 is effective for the Company for interim and annual reporting periods beginning after

December 15, 2009, with one new disclosure effective after December 15, 2010. The Company adopted

this guidance in full beginning with the interim period ended March 31, 2010. See Note 7.

On September 23, 2009, the Financial Accounting Standards Board (‘‘FASB’’) ratified Accounting

Standards Update (‘‘ASU’’) No. 2009-13 (formerly referred to as Emerging Issues Task Force Issue

No. 08-1), Revenue Arrangements with Multiple Deliverables. ASU No. 2009-13 requires the allocation of

consideration among separately identified deliverables contained within an arrangement, based on their

related selling prices. ASU No. 2009-13 will be effective for annual reporting periods beginning

January 1, 2011; however, it will be effective only for revenue arrangements entered into or materially

modified in fiscal years beginning on or after June 15, 2010. Early adoption is permitted. The Company

has been evaluating the impact of ASU No. 2009-13 on its financial position, results of operations, cash

flows, and disclosures. Based on the Company’s research to date, it does not believe the adoption of

ASU No. 2009-13 will have a significant impact on its current accounting; however, the Company does

expect to be required to provide additional financial disclosures due to the full adoption of the

standard beginning in the first quarter of 2011.

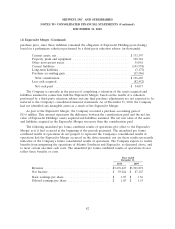

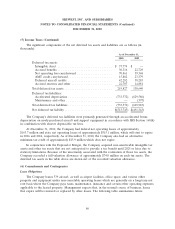

(2) ExpressJet Merger

On November 12, 2010, the Company completed its acquisition of ExpressJet . As a result of the

ExpressJet Merger, each issued and outstanding share of ExpressJet Holdings common stock (other

than shares owned by ExpressJet Holdings as treasury stock or shares owned by the Company or any of

its subsidiaries) was converted into the right to receive $6.75 per share in cash, payable to the holder

thereof, without interest. Based on the number of outstanding shares of ExpressJet Holdings common

stock as of the effective time of the ExpressJet Merger, the aggregate value of the Merger

consideration was $131.6 million. After taking in effect the number of shares acquired by the Company

and its subsidiaries prior to the effective time, the aggregate value of the ExpressJet Merger

consideration was $136.5 million.

In connection with the ExpressJet Merger, ExpressJet and Continental entered into the

Continental CPA, whereby ExpressJet agreed to provide regional airline services in the Continental

flight system. The Continental CPA became effective on November 12, 2010.

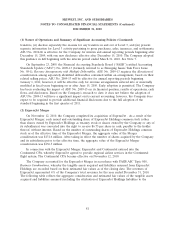

The Company accounted for the ExpressJet Merger in accordance with FASB ASC Topic 805,

Business Combinations, whereby the tangible assets acquired and liabilities assumed from ExpressJet

Holdings are recorded based on their estimated fair values as of the closing date. The revenues of

ExpressJet represented 4% of the Company’s total revenues for the year ended December 31, 2010.

The following table reflects the aggregate consideration and estimated fair values of the tangible assets

acquired and liabilities assumed (including the attribution of ExpressJet Holdings liabilities to the

81